[Asia Economy Reporter Lee Seon-ae] As companies begin to announce their second-quarter earnings in earnest, investment advice has emerged emphasizing the need to focus on companies with a high likelihood of announcing 'earnings surprises.' This is based on the judgment that in a market correction phase where the overall index's upward momentum is slowing and further upward revisions of earnings forecasts for the entire market are unlikely, whether individual stocks deliver earnings surprises becomes crucial.

According to Kyobo Securities on the 10th, the earnings surprise model, which selects stocks with a high probability of earnings surprises, tends to outperform during periods of KOSPI sideways movement and earnings momentum slowdown.

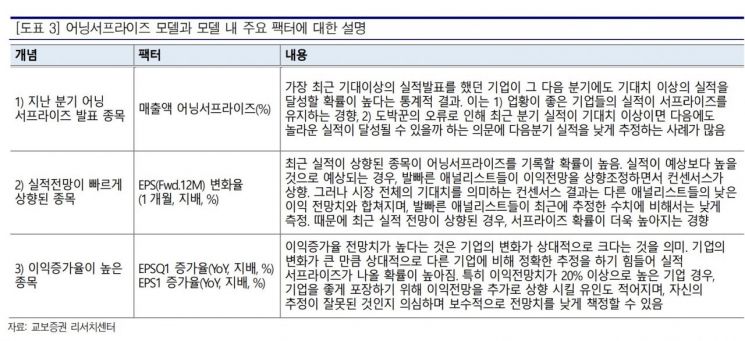

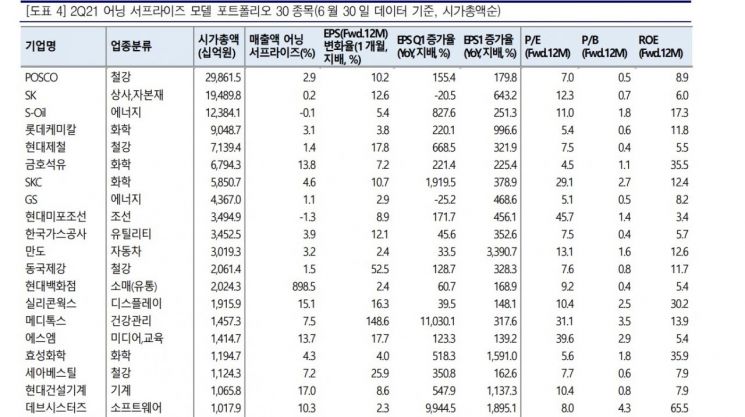

Moon Jong-jin, a researcher at Kyobo Securities, explained, "The core idea of the earnings surprise model is that ▲ companies that announced better-than-expected earnings last quarter ▲ companies with rapidly upwardly revised recent earnings forecasts ▲ companies with excessively high year-over-year earnings growth rates are more likely to announce better-than-expected earnings." He added, "Backtesting with stocks meeting these criteria showed that the probability of discovering earnings surprise stocks increased from 44.3% to 56.8%, and constructing a portfolio with the top 30 stocks achieved an excess return of 12.1 percentage points over the KOSPI in the past five years."

First, the fact that companies announcing earnings surprises last quarter are statistically more likely to exceed expectations again in the next quarter is based on the tendency of companies in favorable industries to maintain surprise earnings. Due to the gambler's fallacy, when recent quarterly earnings exceed expectations, there are many cases where the next quarter's earnings are estimated conservatively, questioning whether another surprising performance can be achieved.

Stocks with rapidly upwardly revised earnings forecasts have a higher probability of recording earnings surprises from a probabilistic perspective. Swift analysts revise earnings forecasts upward, raising the consensus. However, the consensus, which represents the market's overall expectations, combines lower earnings forecasts from other analysts, resulting in a consensus figure that is lower than the most recent estimates by the swift analysts. Therefore, when recent earnings forecasts are revised upward, the likelihood of a surprise tends to increase.

Finally, a high earnings growth forecast indicates relatively significant changes within the company. Because of these substantial changes, it is relatively difficult to make accurate estimates compared to other companies, increasing the probability of earnings surprises. Especially for companies with earnings forecasts exceeding 20%, the incentive to further raise earnings forecasts to present the company favorably decreases, and they may conservatively lower forecasts, doubting whether their estimates were incorrect.

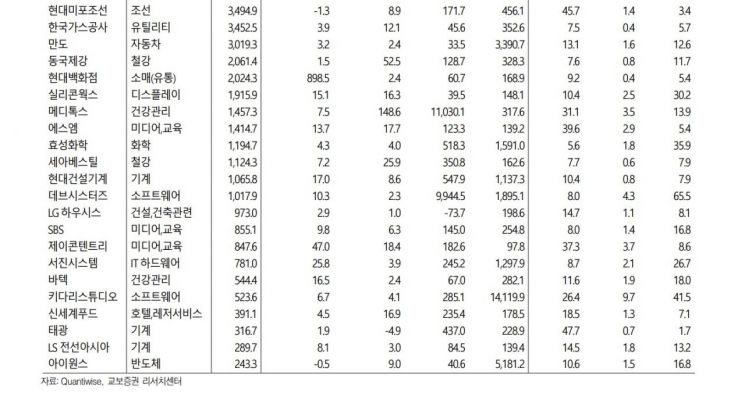

Accordingly, companies with a high likelihood of announcing earnings surprises for the second quarter include POSCO, SK, S-Oil, Lotte Chemical, Hyundai Steel, Kumho Petrochemical, SKC, GS, Hyundai Mipo Dockyard, Korea Gas Corporation, Mando, Dongkuk Steel, Hyundai Department Store, Silicon Works, Medytox, SM, Hyosung Chemical, SeAH Besteel, Hyundai Construction Equipment, Devsisters, LG Hausys, SBS, J Contentree, Seojin System, Vatech, Kidari Studio, Shinsegae Food, Taekwang, LS Cable & System Asia, and iWons. This list is arranged based on market capitalization.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.