Financial Services Commission Holds 'Financial MyData Expert Advisory Meeting'

"Deemed Necessary to Conduct Sufficient Testing for Consumer Protection"

Excessive Marketing Restrictions... Consumer Consent Required When Providing Summary Information

[Asia Economy reporters Kwangho Lee and Kiho Sung] The financial sector's MyData (personal credit information management service) project, originally scheduled to officially launch in August, has been postponed. This decision comes as each operator faces difficulties in development due to the impact of COVID-19, and there is a judgment that sufficient testing is necessary from the perspective of consumer protection.

On the 8th, according to the financial sector, the Financial Services Commission held a 'Financial MyData Expert Advisory Meeting' the previous day with experts, related ministries, and financial sector association officials to discuss these matters.

MyData is a service that collects an individual's financial information scattered across various financial companies so that it can be viewed and managed at a glance. Through this, consumers can enjoy customized information, asset, and credit management services. So far, 28 companies, including KB Kookmin, Shinhan, Woori, and NH Nonghyup Banks, have obtained official approval.

At the meeting, the Financial Services Commission decided to consider postponing the mandatory API implementation deadline to allow sufficient pre-testing. As the demand for non-face-to-face IT development surged due to COVID-19, it became difficult to secure development personnel, and the industry requested a postponement of API mandatory implementation to provide various integrated authentication methods for consumer convenience.

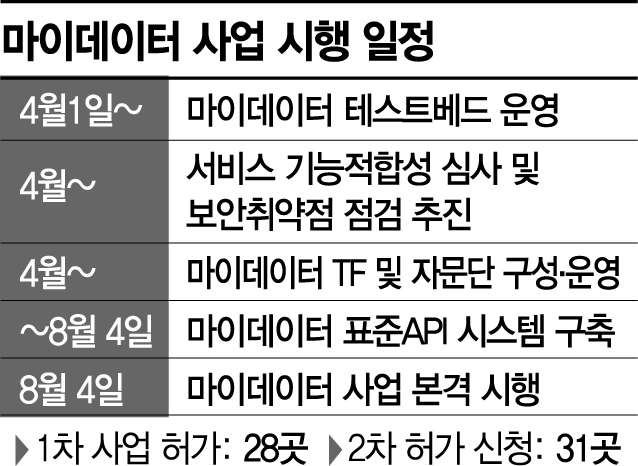

The original plan was that from the 4th of next month, MyData operators would have to stop the existing scraping method (collecting personal information displayed on the screen with customer consent) when gathering customer information from other financial companies and instead use an official program (API) that directly connects to the IT system.

The postponement of mandatory API implementation means delaying the launch of the MyData business. Operators are expected to communicate that about 3 to 4 months will be needed for sufficient testing.

The Financial Services Commission also decided to restrict excessive marketing as many financial companies enter the MyData business. This is to prevent the service from deteriorating into excessive marketing competition rather than differentiation.

Specifically, they are reviewing standards to limit the level of benefits provided to not exceed 30,000 KRW, referring to the restriction levels of benefit provision by financial sectors. Additionally, while not directly limiting the number of subscriptions per consumer, they plan to prepare measures for consumers to be informed of important points before using the MyData service and to check their subscription status.

Furthermore, to protect financial consumers' personal information, when providing transaction details such as account deposit and withdrawal transactions including the account number, name, and memo of the sender/receiver, separate consent from the consumer will be obtained, and MyData operators will be prohibited from using the information for purposes other than the consumer's inquiry.

A Financial Services Commission official emphasized, "We plan to revise the financial MyData operation guidelines within this month by reflecting the discussed contents and conducting additional opinion collection procedures. Considering the mandatory API implementation and the progress of system construction by information providers, we will promptly finalize the specific postponement schedule." He added, "We will monitor and manage the progress to ensure that the financial MyData, which has been operating with scraping since February 4, can quickly transition to the API method."

In this regard, a fintech industry official said, "It is regrettable as we have prepared a lot so far," adding, "I understand the extension is to provide higher quality services, and the related departments are carefully reviewing it."

Another official stated, "Since the intention is to more meticulously review the previously rough system and have a testing period, we view it positively," but expressed, "However, regarding the provision of transaction details, since users who want to use MyData may interpret it as consenting to disclose information, I hope improvements will be made to allow the provision of applicable information."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.