Among 7 Major Credit Card Companies, 5 Offer Minimum Interest Rate of 4%

[Asia Economy Reporter Ki Ha-young] Credit card companies are consecutively lowering the minimum interest rates on card loans (long-term card loans). This is interpreted as a move to attract high-credit customers instead of low-credit demand, due to the reduction in bank loan limits from new lending regulations applied this month and the lowering of the legal maximum interest rate from 24% to 20% starting this month.

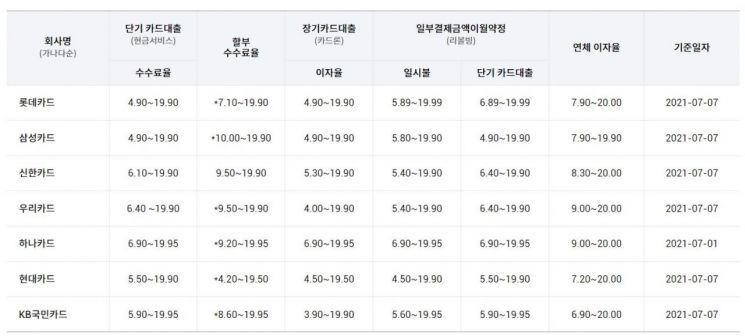

According to the card industry on the 8th, Samsung Card lowered its card loan interest rate by 1 percentage point as of the 7th, adjusting it to an annual rate of 4.9?19.9%. On the same day, Shinhan Card reduced its rate from 5.36% to 5.30%, and Lotte Card from 4.95% to 4.90%. Previously, Hyundai Card also lowered its card loan interest rates to an annual 4.5?19.5%.

Accordingly, the number of full-service card companies offering card loans with a minimum rate of 4% has increased to five, including KB Kookmin Card, Woori Card, Lotte Card, and Hyundai Card. This level is only about 1?2 percentage points higher than the 2?3% annual interest rates on overdraft loans from commercial banks.

This reduction in the minimum card loan interest rates is analyzed as an effort by card companies to target relatively high-credit loan demand. Since last year, as government regulations have raised the threshold for bank loans, high-credit borrowers seeking funds for real estate acquisition and stock investments have begun to show interest in card loans.

In particular, since card loans are not included in the borrower's total debt service ratio (DSR) regulation implemented this month until next year, demand for card loans is expected to increase if additional funds are needed. For card companies, which are expected to face profitability deterioration due to the reduction in the maximum interest rate, high-credit customers are one of the options to increase card loans while lowering the risk of delinquency.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.