Samsung Securities Survey of 782 Financial Asset Holders

"Corporate Earnings Improvement to Accelerate" 47% Expect

"Summer Rally Coming This Year" 64% Forecast

One in Three "KOSPI to Surpass 3600"

55% Choose "Korea" as Top Staycation Destination

Domestic Large-Cap Earnings Stocks Favored Before Summer Vacation

Intent to Buy Overseas Big Tech Growth Stocks

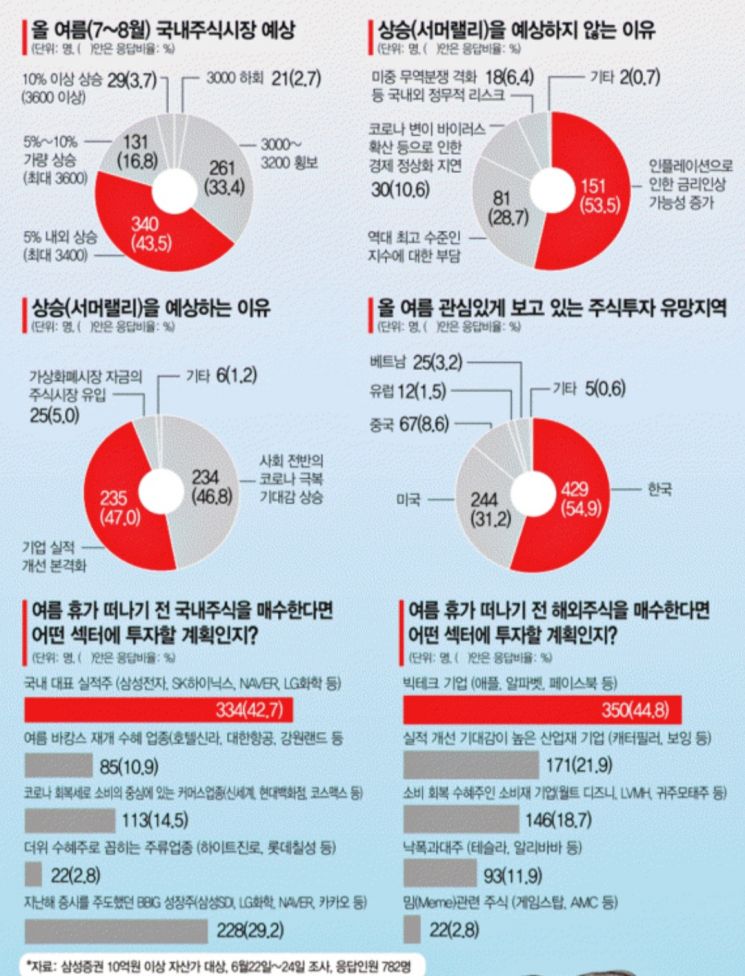

[Asia Economy Reporter Ji-hwan Park] What is the outlook for the domestic stock market in the second half of the year according to high-net-worth individuals (HNWIs) in Korea? More than half of Samsung Securities’ HNWIs holding financial assets worth over 1 billion KRW expect a ‘summer rally’ this summer. One in three expects the KOSPI to rise strongly to the 3600 level. The term ‘summer rally’ refers to a significant rise in stock prices during the summer. This phenomenon occurs because fund managers buy stocks in advance before their summer vacations, anticipating a strong autumn stock market.

63.9% of HNWIs Expect a Summer Rally... 32% Believe KOSPI Could Exceed 3600 Points

On the 6th, Samsung Securities conducted an online survey from June 22 to 24 targeting 782 HNWIs with financial assets exceeding 1 billion KRW. The results showed that 63.9% of respondents expect a summer rally this year. Among those expecting a summer rally, 32% believe that the KOSPI’s peak during July and August could reach or exceed 3600 points, indicating expectations for a very strong summer rally akin to a heatwave.

The main reason cited for expecting a summer rally was ‘the full-scale improvement in corporate earnings (47.0%)’, followed closely by ‘society-wide optimism about overcoming COVID-19 (46.8%)’. Respondents anticipated that not only physical earnings improvements but also improved public sentiment would positively influence investments. Conversely, 36.1% of respondents who did not expect a summer rally cited concerns such as ‘tapering (reduction in asset purchases) and interest rate hikes due to inflation’ as factors that would limit stock price increases.

Summer ‘Tucance’, 54.9% Favor Korean Stock Market... Followed by US, China, Vietnam

HNWIs favored the domestic stock market (54.9%) as the most promising investment destination for this summer’s so-called ‘Tucance’ (investment + vacation). Following Korea were the United States (31.2%), China (8.6%), and Vietnam (3.2%). The preference for Korea is attributed to continued export growth for seven consecutive months through May, which has raised expectations for corporate earnings growth and economic recovery compared to other regions.

The domestic stock themes that investors wanted to buy before their summer vacations included large-cap earnings leaders such as Samsung Electronics, SK Hynix, and NAVER (42.7%). Following these were growth stocks in battery, bio, internet, and gaming sectors (BBIG) like Samsung SDI, LG Chem, and Kakao (29.2%), as well as companies showing earnings recovery related to COVID-19 such as Shinsegae and Hyundai Department Store.

For overseas stocks, 44.8% of respondents chose major US big-tech growth stocks such as Apple, Alphabet, and Facebook as themes they wanted to buy before summer vacations. Industrial stocks with high earnings improvement expectations like Caterpillar and Boeing followed with 21.9% preference. Notably, domestic recovery-related beneficiaries were consumer goods, while overseas beneficiaries were centered on industrial goods.

Only 2.8% of respondents considered investing in meme stocks with high volatility such as GameStop (GME) and AMC Entertainment (AMC), reflecting HNWIs’ caution toward highly volatile assets.

The top five net purchases of domestic stocks by HNWIs with over 1 billion KRW in assets from January 1 to May 31 this year were all large-cap stocks listed on the exchange. Samsung Electronics, SK Hynix, and Kia, representing their respective industries, ranked high. Overseas stock purchases also focused on large-cap growth stocks like Tesla and Apple, as well as COVID-19-hit stocks like Boeing.

HNWIs Trade via Mobile and Study Investments on YouTube

Regarding the biggest change in investment methods since the COVID-19 pandemic, 30.1% responded that the spread of non-face-to-face culture has increased the use of Mobile Trading Systems (MTS), enabling them to check stock prices and news and trade anytime, anywhere.

Among clients with assets over 1 billion KRW who actually traded, the proportion using online channels surged from 54.7% at the end of 2019 to 71.0% at the end of last year. Additionally, 25.1% reported studying through securities firms’ YouTube videos and applying that knowledge to their investments, indicating that information acquisition channels are diversifying online.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)