Successful Experiments of In-House Ventures Reflecting Young Ideas

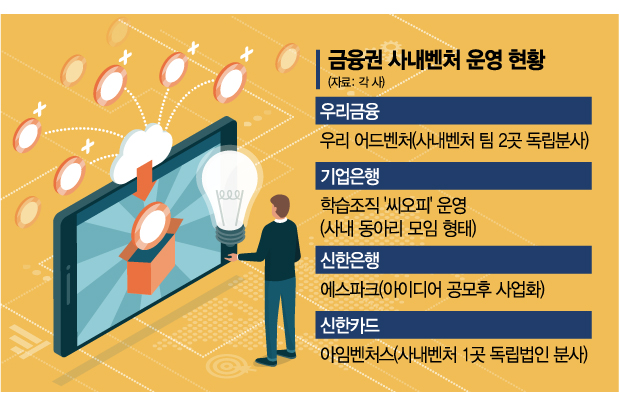

Woori Financial, First Holding Company to Spin Off Two In-House Venture Teams as Independent Firms

Shinhan, IBK, and Others Also Operate In-House Venture Development Programs

[Asia Economy Reporter Kim Jin-ho] Financial companies' efforts to find the ‘future food source’ have begun to bear fruit. Internal venture experiments that incorporate young and fresh ideas into business are gradually succeeding. As the pace of digital transformation accelerates, financial companies are also analyzed to be driven by the urgent need to ‘change to survive,’ much like IT companies. The bold attempts by financial companies to nurture internal ventures are expected to accelerate further.

According to the financial sector on the 6th, Woori Financial Group recently spun off its first internal venture teams selected through the internal venture nurturing program ‘Woori Adventure’ into independent companies. This is the first case among domestic financial holding companies.

Woori Adventure refers to a daring venture group that challenges with free and innovative ideas across fields from analog to digital. About 50 teams were selected, and through three rounds of evaluation, two teams were chosen and intensively nurtured over the past 10 months.

The internal venture teams spun off as independent companies are Woori Bank’s ‘WooriTem’ and Woori FIS’s ‘Midgo Matgyeo.’ ‘WooriTem’ offers a ‘P2P rental service’ where individuals can rent items such as cameras and professional equipment to each other, while ‘Midgo Matgyeo’ launches a ‘storage service’ that stores and manages personal items like seasonal clothing collections.

The spin-off of these internal venture teams into independent companies is the first tangible result of Chairman Sohn Tae-seung’s will to instill ‘innovation DNA’ in group employees. To break away from the financial sector’s typically conservative organizational culture and risk-averse work style, Woori Financial also granted them a ‘back option.’ They can return to their original company anytime within three years, and all their accumulated experience will be recognized. This means they should boldly focus on new business ventures without worrying about failure.

Hana Financial Group has maintained three teams under Hana Financial TI as independent spin-offs since starting its internal venture system in 2018. Hana Bank has also dispatched employees to companies participating in the startup nurturing program ‘OneQ Agile Lab.’

Shinhan Bank plans to resume ‘S-Park’ from the 7th of this month. S-Park is an internal venture system that collects ideas from employees and supports their commercialization. This year, a special program will be operated for the top three teams among the submitted ideas. The three teams selected in October will participate in projects developing core programs or products alongside external professional developers, while being excluded from their regular duties.

IBK Industrial Bank also has an internal venture program. It operates two teams: ‘Creative,’ which produces financial content, and ‘IBK Bobaek,’ which designs business models supporting small and medium enterprises. The Creative cell collaborates with the bank’s digital channel department, while IBK Bobaek designs business models for SMEs.

Shinhan Card was the first in the card industry to spin off ‘CV3,’ nurtured through the internal venture program ‘I’m Ventures,’ into an independent corporation. ‘CV3’ operates the shopping information subscription platform app ‘Before Shopping.’

The reason financial companies are strengthening internal venture experiments one after another is interpreted as a reflection of the crisis awareness that ‘if you don’t change, you die.’ To overcome fierce challenges from big tech (large information and communication companies) and fintech (finance + technology), discovering new businesses in response is urgent. A banking sector official said, "There is growing support for actively nurturing internal ventures like IT companies to break conservative cultures and achieve innovation," adding, "Attention is being paid to the fact that a well-developed internal venture can become a future growth engine."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)