Annual 4%P Drop After 3 Years... 40,000 People May Use Illegal Private Loans

[Asia Economy Reporter Kwangho Lee] From the 7th, the statutory maximum interest rate will be lowered from 24% to 20%. The purpose is to reduce the burden on high-interest loan users, but even the loan industry, which is the last bastion of the institutional financial sector, is tightening loan screening to maintain profitability, so it is expected that many low-credit borrowers will be pushed into illegal private loans. The financial authorities have stated that they will make every effort to ensure that no financial consumers suffer damage due to the reduction of the statutory maximum interest rate.

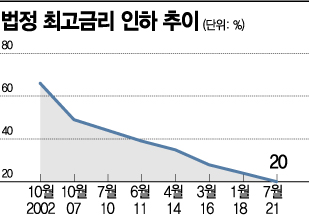

According to the financial sector on the 6th, the statutory maximum interest rate will be lowered by 4 percentage points annually for the first time in three years since the reduction in 2018 (from 27.9% to 24%).

Secondary financial institutions such as savings banks, credit cards, and capital companies have decided to apply the interest rate reduction to customers who were previously burdened with interest rates exceeding 20%. Accordingly, it is expected that 582,000 customers of savings banks will benefit from interest reduction amounting to 244.4 billion KRW. For credit cards, 2,467,000 customers, and for capital companies, 175,000 customers will be subject to the interest rate reduction, with expected interest savings of 81.6 billion KRW and 35 billion KRW respectively.

Loan Industry, Difficult to Apply Retroactively... Business Abandonment and Loan Tightening

However, loan companies will not apply the interest rate reduction retroactively to existing customers. They argue that it is difficult to apply retroactively due to reduced profitability caused by the statutory maximum interest rate reduction. Loan companies have already been abandoning their businesses or tightening loans due to deteriorating profitability following the statutory maximum interest rate reduction.

According to the "2020 Second Half Loan Industry Survey" released by the Financial Supervisory Service, as of the end of last year, the loan balance of the loan industry was 14.5363 trillion KRW, a decrease of 506.8 billion KRW (3.4%) compared to June of the previous year (15.0431 trillion KRW). During the same period, the proportion of secured loans increased by about 10%.

This means that loan companies are requiring collateral from low-credit borrowers, and low-credit borrowers without collateral have no place to borrow money, increasing the likelihood of turning to illegal private loans.

The government expects that when this measure is implemented, among the 2.39 million people who used loans with interest rates exceeding 20% as of the end of March last year, about 13%, or 316,000 people (2 trillion KRW), will reduce their use of private finance over the next 3 to 4 years as their loan maturities come due, and among them, about 39,000 people (230 billion KRW) are likely to use illegal private loans.

Expansion of Safety Net Loans... Market Inspection and Supervision Strengthening

Therefore, the government will supply about 300 billion KRW of "Safety Net Loan II" by 2022 for borrowers who cannot extend their existing loans. Among borrowers who took out loans with interest rates exceeding 20% before the 7th, those who have used the loan for more than one year, whose maturity is within six months, and whose annual income is 35 million KRW or less, or annual income is 45 million KRW or less with a personal credit score in the bottom 20%, are eligible. The loan limit ranges from a maximum of 20 million KRW up to the balance of existing high-interest loans, and loans can be applied for at banks through the Korea Inclusive Finance Agency or the Integrated Support Center for Inclusive Finance.

The low-income loan product "Haetsalron 17" will also be renamed "Haetsalron 15" and its interest rate lowered in line with the statutory maximum interest rate reduction. The interest rate for Haetsalron 15 will be 15.9% annually for contracts made after the 7th.

In addition, market inspection and supervision will be strengthened. The Financial Supervisory Service plans to continuously guide the industry to ensure no difficulties in loan use after the maximum interest rate reduction and will focus on monitoring credit supply conditions and violations of the maximum interest rate. Monthly monitoring of credit loan applications, approvals, and applied interest rates for low-credit borrowers will also be conducted.

Furthermore, related systems will be improved so that savings banks and credit finance companies can absorb low-credit borrowers following the maximum interest rate reduction. From next month, the model standard for savings bank loan interest rate calculation systems will be revised and implemented, and from January next year, incentives for mid-interest loans in the secondary financial sector will be expanded, and penalties for high-interest loans will be abolished.

Prime Minister Kim Boo-kyum is visiting the Central Low-Income Financial Support Center in Jung-gu, Seoul on the 5th to check the status of support for low-income financial services. Photo by Kim Hyun-min kimhyun81@

Prime Minister Kim Boo-kyum is visiting the Central Low-Income Financial Support Center in Jung-gu, Seoul on the 5th to check the status of support for low-income financial services. Photo by Kim Hyun-min kimhyun81@

Kim Boo-kyum: "Illegal Debt Collection Will Be Thoroughly Eradicated Through Enhanced Punishment"

Prime Minister Kim Boo-kyum visited the Integrated Support Center for Inclusive Finance on the 5th and said, "With the reduction of the maximum interest rate, the burden on those who had no choice but to borrow at high interest rates has been somewhat alleviated," adding, "We must strengthen publicity and guidance so that many people can receive the support prepared by the government."

He continued, "Illegal debt collection is a serious crime that can destroy the lives of ordinary people. The police and related agencies will intensively crack down on illegal debt collection through cooperation among related organizations, and organized illegal debt collection involving gangs and brokers will be subject to enhanced punishment under the Criminal Act for organizing criminal groups and the Act on the Punishment of Violent Acts, etc.," emphasizing, "To protect consumers, we will actively implement confiscation and recovery measures to thoroughly recover criminal proceeds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.