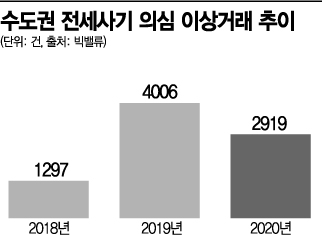

Analysis of Anomalous Transaction Detection System: Over 8,400 Cases in the Seoul Metropolitan Area in 3 Years

Jeonse Contracts Signed at Prices Higher Than Sales Prices of Multi-family and Row Houses

Landlords Intentionally Declare Bankruptcy... Tenants Unable to Receive Jeonse Deposits

Newly Built Villas with Difficult Market Price Assessment Targeted

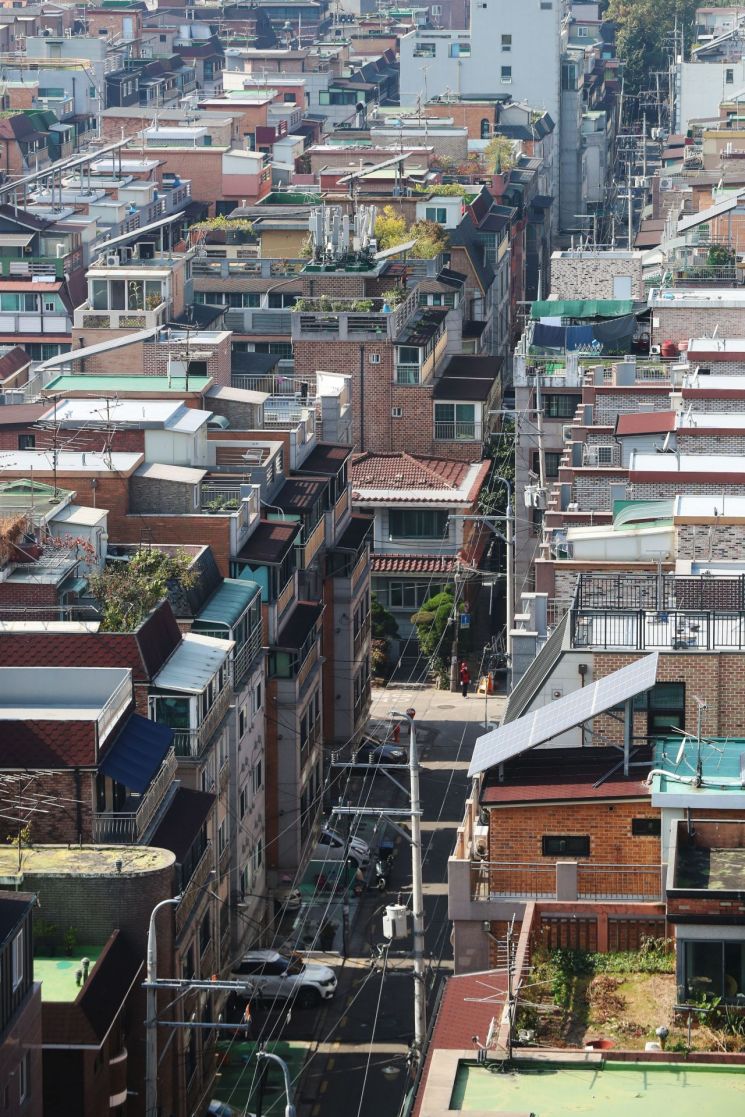

The shortage of jeonse (long-term lease) properties and the surge in jeonse prices have continued for nearly three months since the new Lease Protection Act came into effect in July, leading more tenants to seek multi-family houses and villas as alternative options to apartments. The photo shows a dense area of villas and multi-family houses in Songpa-gu, Seoul. (Photo by Yonhap News)

The shortage of jeonse (long-term lease) properties and the surge in jeonse prices have continued for nearly three months since the new Lease Protection Act came into effect in July, leading more tenants to seek multi-family houses and villas as alternative options to apartments. The photo shows a dense area of villas and multi-family houses in Songpa-gu, Seoul. (Photo by Yonhap News)

[Asia Economy Reporter Ryu Tae-min] Newlywed couple Mr. A, whose lease contract was about to expire, suddenly became a victim of a "Kkangtong Jeonse" (empty deposit rental) scam. Although he had already paid the deposit for a new rental house, the landlord of his previous rental property deliberately filed for bankruptcy, causing the house to go to auction and preventing him from recovering his deposit. Mr. A ended up losing his deposit and had to live with his child, who was not even two years old, at his parents' home.

The Jeonse rental crisis in Seoul and the metropolitan area is reigniting, spreading concerns about Kkangtong Jeonse particularly in low-priced housing such as row houses and multi-family houses. Unlike apartments, it is difficult to ascertain the market price of row houses and multi-family houses, and since there is almost no gap between sale and Jeonse prices, these properties have become targets for Jeonse fraud using gap investment.

On the 5th, Asia Economy commissioned real estate big data company BigValue to analyze suspicious transactions through the Fraud Detection System (FDS). The analysis revealed that from 2018 to last year, a total of 8,468 suspicious transactions suspected of "gap investment planned bankruptcy" occurred in the metropolitan area over the past three years. These transactions involve multi-homeowners owning at least 30 row houses or multi-family houses who signed Jeonse contracts with deposits equal to or higher than the sale price and then sold the property within three months.

The number of related transactions surged from 1,297 in 2018 to 4,006 in 2019. Last year, the number still reached 2,919. In particular, in Incheon, the number increased sharply from 133 in 2018 to 888 in 2019 and 918 last year.

Gap investment planned bankruptcy typically involves landlords, real estate agents, and owners of row houses or multi-family houses who want to sell. For example, a real estate agent introduces a tenant looking for a Jeonse house to a property priced at 200 million KRW, but the agent arranges a Jeonse contract at 220 million KRW with the owner. Then, the landlord sells the house to a rental business operator for 200 million KRW, although the contract states 220 million KRW. The landlord disposes of a troublesome property, the rental business operator acquires the house without any cost, and the 20 million KRW difference obtained from the tenant is shared with the agent. This method is repeated across dozens of houses to generate profits.

The problem is that tenants only realize they have been victimized when the Jeonse contract ends. When tenants demand the return of their Jeonse deposit, the rental business operator, now the landlord, claims inability to refund and deliberately files for bankruptcy. The house goes to auction, and tenants fail to recover their deposits on time.

Jeonse fraud mainly occurs in newly built villas where it is difficult to verify sale prices. Unlike apartments, which have many sales transactions in the same complex making price verification easier, villas have fewer transactions, making price assessment difficult. Newly built villas with almost no comparable nearby prices are especially vulnerable to fraud.

Recently, in the metropolitan area, villa sale prices have skyrocketed following apartments, so even if a sale contract is signed one or two months after a Jeonse contract at a price higher than the Jeonse deposit, industry insiders say it appears to be a normal transaction.

Attorney Cho Jo-se-young of Law Firm Rowin advised, "Even if tenants have subscribed to Jeonse deposit return guarantee insurance, they inevitably suffer time and financial losses before recovering their deposits." He added, "In the current Jeonse crisis, if a Jeonse property is offered under too good conditions, it is necessary to be suspicious." Attorney Cho also emphasized, "Carefully checking the sale and Jeonse prices of nearby villas before signing a contract can reduce the risk of fraud."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.