Samsung Securities Report

Antitrust Lawsuit Dismissal Ruling Also Positive for Stock Price

[Asia Economy Reporter Minji Lee] As Facebook continues its high growth trend with an e-commerce-centered monetization strategy, there are forecasts that its stock price will rise further in the second half of the year.

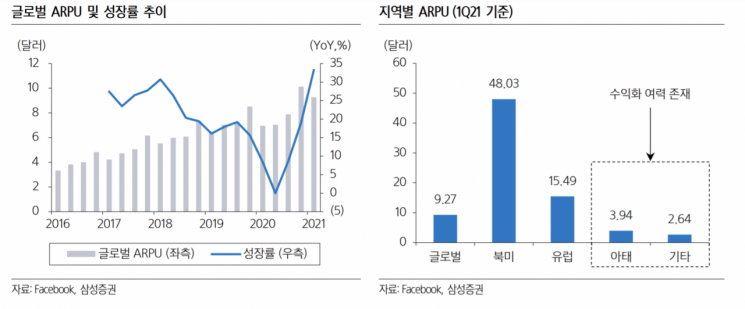

On the 4th, Facebook's stock price rose about 32% from 268.94 to 354.70 this year. The expansion of investment sentiment toward platform companies and solid revenue growth drove the stock price up. Looking at Facebook's revenue growth, it shows a high level exceeding the pre-COVID-19 period. While the revenue growth rate was about 29.6% in 2019 compared to a year ago, it reached 33.2% in Q4 last year and 47.6% in Q1 this year. This is because brand advertising recovered due to the reopening of the economy, and additional monetization momentum centered on WhatsApp and Instagram has appeared.

Q2 revenue is expected to continue the high growth trend with a 38.4% increase year-over-year. This is because the e-commerce sector's strong performance and the continued rise in advertising unit prices are expected. However, due to the peak-out of the COVID-19 effect, the pure monthly active user (MAU) growth using the service during one month of Q2 is expected to slow somewhat compared to the previous quarter.

Although the effect of Apple's strengthened privacy policy will be fully reflected in Q2, it is judged that no negative impact will appear. Samsung Securities researcher Kim Joong-han explained, "Network advertising affected by Apple's advertising identifier is estimated to account for less than 5% of total revenue," adding, "Considering data collection through its own SDK and the e-commerce-centered monetization trend, it is sufficiently possible to overcome."

The active pursuit of profitability is also attractive. Recently, Facebook announced a strategic direction at the F8 Developer Conference to integrate Facebook, Instagram, and WhatsApp and build a business ecosystem centered on e-commerce. Researcher Kim said, "The combination of e-commerce and advertising is positive in that it can maximize the momentum of the U.S. economic recovery in the second half of the year," adding, "Unless there is an economic peak-out, the possibility of a sharp slowdown in revenue growth is limited."

Benefits from the blooming VR market are also expected. As of Q1, revenue from the 'Other' segment, which includes Oculus Quest 2 sales, recorded $730 million, a 147% increase compared to the same period last year, and is estimated to grow 156% compared to the previous quarter. Expectations for new releases such as Biohazard VR scheduled for the second half of the year are growing, and based on the success of major titles, Facebook is expected to solidify its leading position within the VR platform.

Researcher Kim said, "With the recent court dismissal of the antitrust lawsuit, uncertainty has eased, and additional re-rating is expected," adding, "Considering the relatively attractive price compared to the overall high valuation of the platform, there is no need to underestimate the ecosystem involving 3.5 billion participants."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.