Sparkling Growth in the Carbonated Water Market... Unshakable No.1 Lotte Chilsung Trevi

Coca-Cola Seagram Label Free Performs Well, 27.% Growth Compared to Last Year

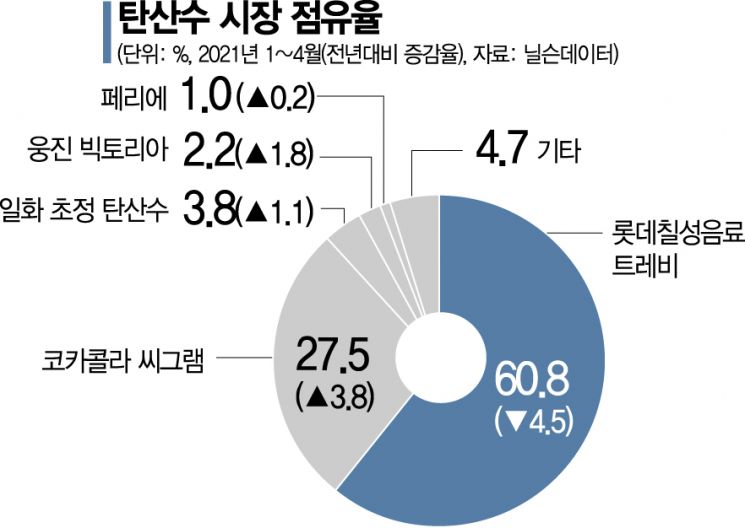

[Asia Economy Reporter Lim Hye-seon] The sparkling water market has been rapidly growing since the COVID-19 pandemic. While Lotte Chilsung's 'Trevi,' which holds an unshakable No. 1 market share, accounts for 60% of the market, Coca-Cola's 'Seagram,' which was the first to introduce label-free packaging emphasizing eco-friendliness, is making significant strides.

Is the Rebellion of the Second Place Beginning?

According to Nielsen Korea on the 2nd, Seagram's sales in the retail market from January to April reached 8 billion KRW, a 28.8% increase compared to the same period last year. Consequently, its market share rose from 24.1% at the end of last year to 27.5% this year. Online sales also surged. On an online mall A, Seagram's sales grew by 150% year-on-year this year.

While Lotte Chilsung Beverage's Trevi continues its dominance, there has been no major shift in the sparkling water market landscape, but Seagram is holding its ground well. During the same period, Trevi's sales were 17.8 billion KRW, a 3.4% increase compared to the previous year. Its market share decreased from 65.3% to 60.8%. Ilhwa's Chojung sparkling water sales dropped from 1.3 billion KRW to 1.1 billion KRW.

Industry insiders attribute Seagram's growth to the swift adoption of 'label-free packaging.' This is due to the recent spread of environmentally conscious consumption. In January this year, Coca-Cola launched 'Seagram Label-Free,' the first label-free sparkling beverage in Korea. Seagram Label-Free goes beyond just removing the label; it also achieves plastic lightweighting in PET bottles. By eliminating the hassle of removing labels during recycling, it enhances convenience and is positively evaluated by consumers for promoting sustainable consumption. As a result, companies expanding product packaging with eco-friendly significance are continuously increasing. In May, Trevi also released the 'Trevi Eco' product without labels.

Sparkling Water Market Expected to Grow at an Annual Rate of 3.5%

The sparkling water market is expected to continue growing this year. Last year, the market size reached 106.4 billion KRW, a 15.6% increase from the previous year (91.8 billion KRW). It has expanded 30 times in 10 years from about 3 billion KRW in 2010. The industry forecasts that sparkling water sales will grow at an average annual rate of 3.5% until 2025.

By distribution channel, the online channel is expected to grow. According to Euromonitor, as of last year, large supermarkets accounted for the largest share at 27.8%, followed by online (23.8%), convenience stores (22.5%), and independent supermarkets (11.1%). Compared to 2019, before the spread of COVID-19, large supermarkets decreased by 6.3 percentage points from 34.1%, while online increased by 7.0 percentage points from 16.8%. For the first time, the online channel surpassed the convenience store channel. Interest in sparkling water was higher among women (66%) than men (34%).

A representative from the Korea Agro-Fisheries & Food Trade Corporation (aT) explained, "Various flavored sparkling waters with added fruit flavors are gaining popularity among young people in their teens and twenties, reflecting increasingly complex consumer preferences. In packaging, interest in small sizes and cans has increased, and label-free products ranked high in Naver Data Lab Shopping Insights due to changes in environmental awareness." They added, "The online channel continues to grow and is expected to surpass large supermarkets this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.