Concentration of Cyclical Industries

15.32% Return Since Early Year

Outperforming Domestic and Overseas Equity Returns

[Asia Economy Reporter Minji Lee] As expectations for economic activity recovery rise and price burdens on large-cap stocks expand, the performance of small and mid-cap stocks has stood out, leading to soaring returns for related funds.

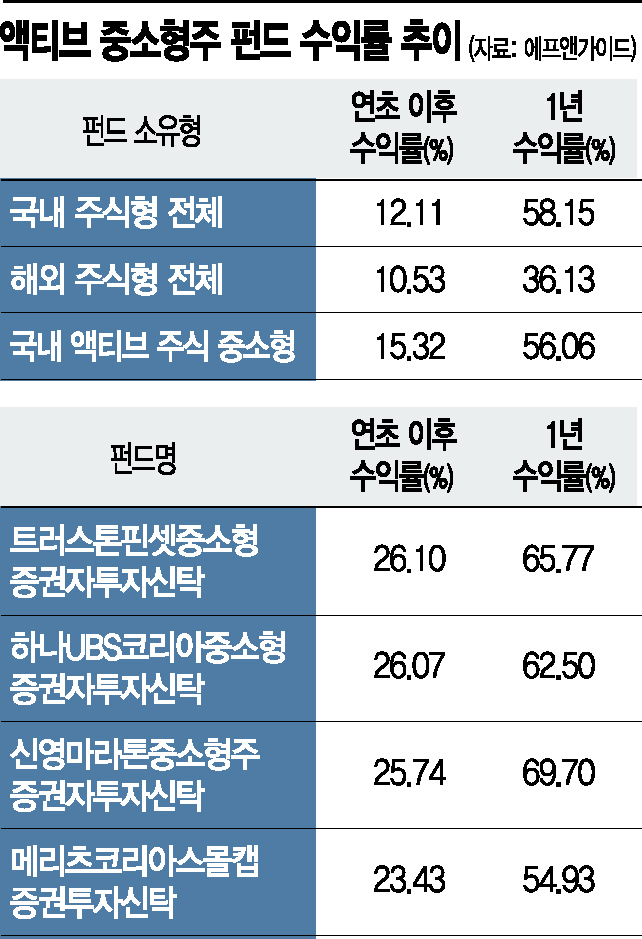

According to financial information provider FnGuide on the 30th, among 54 active small and mid-cap equity funds with assets under management of over 1 billion KRW as of the previous day, the year-to-date return was 15.32%, surpassing the average returns of all domestic equity funds (12.11%) and all overseas equity funds (10.53%).

It is analyzed that this was influenced by increased investor sentiment toward small and mid-cap stocks, which had risen relatively less after large-cap stocks steadily increased following COVID-19 last year, creating price burdens. The returns of large-cap and small and mid-cap stocks within the KOSPI also showed differentiation. Large-cap stocks rose only 12.8% since the beginning of the year, while mid-cap and small-cap stocks increased by approximately 22% and 29%, respectively.

The fact that many economically sensitive sectors are concentrated in small and mid-cap stocks also contributed to higher returns. Daeseok Kang, a researcher at Eugene Investment & Securities, explained, "As domestic consumption shows signs of recovery, small and mid-cap stocks tend to perform better in phases where domestic demand improves," adding, "With investor sentiment toward the semiconductor sector relatively cooling, the trend of rising small and mid-cap stocks is expected to continue."

Looking at individual funds, the ‘Truston Pinset Small and Mid-Cap Fund’ posted the best performance with a 26.28% return since the beginning of the year. This fund aims to invest intensively in growth-potential sectors and companies improving governance, focusing on eco-friendly and platform industries. In terms of stock weightings, besides Samsung Electronics (6.13%) and SK Hynix (5.97%), it held significant positions in JC Chemical (4.24%), Kooksoondang (4.16%), SoluM (3.9%), Kona I (3.71%), CS Wind (3.5%), S-1 Corporation (3.4%), and DL Construction (3.35%). JC Chemical, a biofuel specialist, saw its stock price rise by 60% since the start of the year, and Kona I also achieved a 63% return this year, driven by growth in its prepaid card payment platform.

The ‘Hana UBS Korea Small and Mid-Cap Securities Investment Trust,’ which invests in stocks with high growth potential, followed with a 26.7% return. Its major holdings included Daewoo Construction (3.94%), Hyundai Mipo Dockyard (3.5%), Pan Ocean (3.14%), DB HiTek (2.99%), Hwasung (2.86%), and F&F (2.82%).

The increased returns have heightened redemption desires for profit-taking. Since the beginning of the year, 400 billion KRW has been withdrawn from active small and mid-cap equity funds. However, some funds have seen steady inflows, with the ‘Asset One Public Offering KOSDAQ Venture Fund,’ which invests in public offerings, attracting the largest inflow of 77.7 billion KRW. Other funds receiving inflows include ‘Woori GBest Small and Mid-Cap Fund’ (9.6 billion KRW), ‘BNK Samsung Electronics Small and Mid-Cap Fund’ (3.2 billion KRW), and ‘Mirae Asset Growth Potential Small and Mid-Cap Pension Savings Securities Conversion Type’ (1.7 billion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.