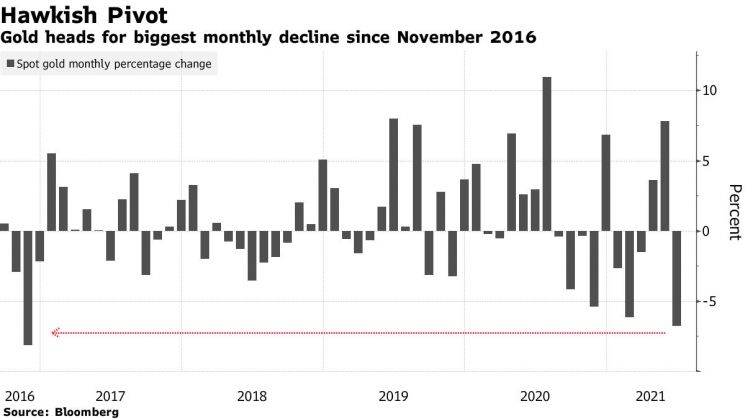

[Asia Economy Reporter Park Byung-hee] Gold prices have fallen nearly 7% this month, expected to record the worst monthly performance since November 2016, Bloomberg reported on the 29th (local time).

On the morning of the same day, gold spot prices in the Singapore market briefly reached $1,776.76 per ounce. This was a 0.2% decline from the previous trading day, expanding the monthly drop to 6.8%.

Bloomberg diagnosed that gold prices are weakening due to the strong dollar. It explained that the Federal Reserve's (Fed) hawkish stance, including the earlier-than-expected timing of U.S. interest rate hikes indicated in the Fed's dot plot, is the background for the dollar's strength.

The Bloomberg Dollar Spot Index has risen 1.8% this month, recording the highest monthly return since March 2000.

The rising risk appetite among investors, as seen in U.S. and European stock markets repeatedly hitting all-time highs, is also a negative factor for the safe-haven gold prices. Despite the spread of the Delta variant, investors' expectations for a global economic recovery seem to be growing.

John Finney, manager of Guardian Gold, a gold trading company based in Sydney, Australia, said, "The Fed's shift to a hawkish stance appears to have already been reflected in gold prices," adding, "We believe gold prices are testing support at $1,775 per ounce."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.