[Asia Economy Reporter Ji Yeon-jin] Last year, the surge in stock investment enthusiasm, including the Donghak Ant Movement, led to an increase in contract performance and performance fees for dedicated investment advisory firms, resulting in more than double the fee income.

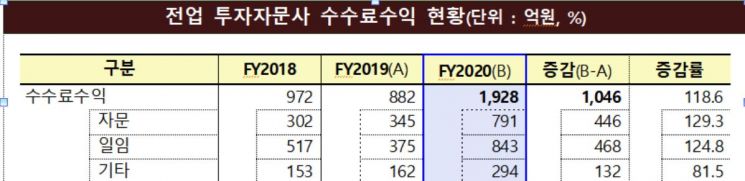

According to the 2020 business year operating performance of dedicated investment advisory firms released by the Financial Supervisory Service on the 28th, fee income from April last year to March this year was 192.8 billion KRW, an increase of 104.6 billion KRW (118.8%) compared to the same period last year (88.2 billion KRW).

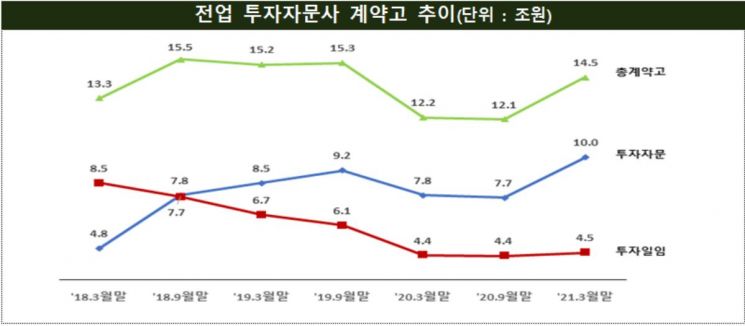

As of the end of March this year, the total contract amount of dedicated investment advisory firms was 14.5 trillion KRW, an increase of 2.3 trillion KRW (18.6%) compared to one year ago. From April last year to March this year, fee income was 192.8 billion KRW, up 104.6 billion KRW (118.8%) from 88.2 billion KRW in the same period last year.

The advisory contract amount recorded 10 trillion KRW, increasing by 2.2 trillion KRW (27.6%) compared to one year ago, as investment advisory activities such as securities firms' wrap accounts became more active, and during the same period, the discretionary contract amount rose by 100 billion KRW (2.2%) to 5 trillion KRW.

During this period, the net profit of dedicated investment advisory firms was 242.6 billion KRW, a sharp increase of 280.3 billion KRW compared to the previous year (-33.7 billion KRW). The return on equity (ROE) was 39.0%, up 46.5 percentage points from -7.5% in the same period last year.

Among a total of 228 companies, 176 posted profits (262 billion KRW), while 52 recorded losses, resulting in a profit ratio of 77.2%, an increase of 49.8 percentage points compared to the previous year.

Proprietary asset management gains also surged by 289.8 billion KRW compared to the same period last year to 229.2 billion KRW, driven by investment gains from the strong stock market.

The Financial Supervisory Service stated, "The management performance of investment advisory firms is greatly affected by stock market fluctuations and changes in contract amounts. Therefore, in preparation for market volatility due to future interest rate hikes, we plan to strengthen monitoring of each company's contract trends, financial status, and risk of insolvency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)