Rising Zombie Companies Amid Low Interest Rates... Overwhelming Share of SMEs

BOK Signals Interest Rate Hike Within the Year... Increased Burden on SMEs and Self-Employed

Interest Burden Due to Rate Hike... "Concerns Over Financial Sector Systemic Transmission"

[Asia Economy Reporters Sunmi Park and Jinho Kim] As business conditions for companies are expected to worsen further in the second half of this year, warning signs have been raised over the deterioration of marginal companies with low chances of normalization. This is due to Lee Ju-yeol, Governor of the Bank of Korea, setting the timing for the base interest rate hike within this year, and the COVID-19 financial support ending in September. In particular, government financial support measures for small and medium-sized enterprises (SMEs) and self-employed individuals who are unable to even pay interest to banks are showing signs of turning into bad debts, raising concerns that a chain of bankruptcies could deal a fatal blow not only to financial sector risks but also to the growth of the Korean economy. Experts warn that with interest rate hikes expected in the second half, the clock for corporate restructuring must also move faster.

Zombie Companies Increasing Despite Low Interest Rates

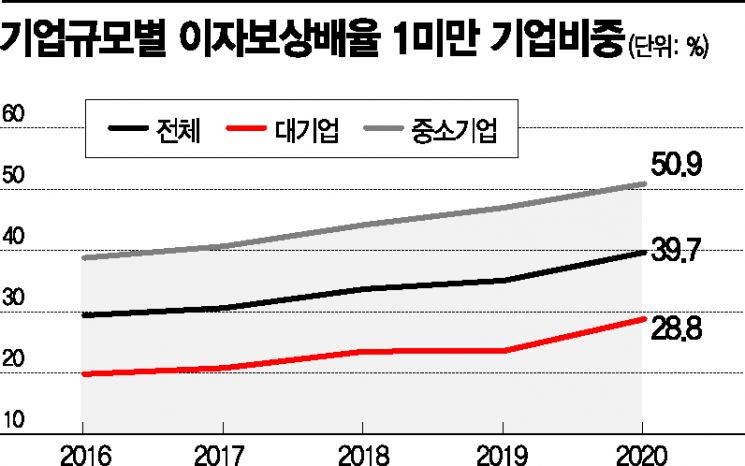

According to the Bank of Korea and financial authorities on the 25th, among 2,520 companies disclosing financial statements as of the end of last year, 1,001 (39.7%) were marginal companies with an interest coverage ratio below 1. This is higher than the 33.2% recorded at the end of 2008 during the global financial crisis.

The proportion of these marginal companies in total corporate loans stands at 32.2%, higher than the 24.8% of major countries. The increase in the share of loans to companies with weak repayment capacity indicates a significantly heightened risk of corporate insolvency in the event of domestic or external shocks.

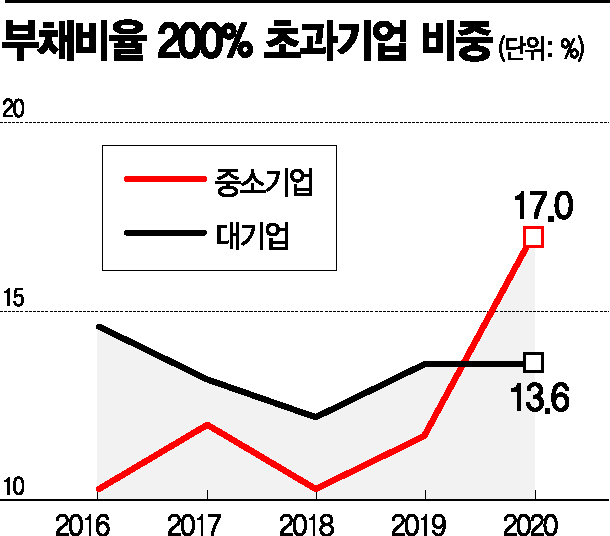

It is particularly concerning that among these marginal companies, SMEs account for 633, or 63.2% of the total, amid financial institutions significantly increasing SME loans in line with government policy directions. Despite the ultra-low interest rate environment in recent years, the number of SMEs unable to repay both principal and interest has increased. The average interest rate on SME loans in the banking sector in the first quarter of this year was 2.88% per annum, which is more than 1 percentage point lower than 3.92% in the first quarter of 2019 and considerably lower than 3.32% in the first quarter of last year.

The large share of SMEs among marginal companies is attributed to a significant deterioration in profitability due to the impact of COVID-19, despite accommodative financial conditions such as low interest rates. While large and medium-sized enterprises of a certain scale have been able to withstand the worsening business environment caused by COVID-19, SMEs have been directly hit. In fact, the sales growth rate of SMEs last year was 0.8%, half of the 1.5% recorded in 2019 before COVID-19.

The share of loans to vulnerable companies amounts to 139.9 trillion won, which is 32.2% of the total financial institution loans of 434.1 trillion won, and this proportion has been rising since 2017. For companies with operating losses, both the number of companies and average loan size have increased, raising their loan share to 21.5%, up 6.0 percentage points from the previous year. The significant increase in average loans to vulnerable companies, supported by accommodative borrowing conditions, has created an illusion of reduced default risk through borrowing despite worsening profitability.

Concerns Over Mass Bankruptcies of Zombie Companies if Interest Rates Rise

With the likelihood of a base interest rate hike within the year increasing, the growing interest payments SMEs must make and the normalization of temporary financial support measures related to COVID-19 starting in September are raising the possibility of mass bankruptcies among SMEs.

Governor Lee Ju-yeol of the Bank of Korea fixed the timing for the interest rate hike within this year. Previously, he had stated, "If a solid recovery trend continues, accommodative monetary policy should be normalized at an appropriate time in the future," and recently said, "It is necessary to orderly normalize monetary policy at a not-late point within this year," specifying the timing within this year.

Even under ultra-low interest rates, some SMEs could not pay interest, and if the base rate rises, the debt burden on vulnerable SMEs will inevitably balloon like a snowball. The industry estimates that a 0.09 percentage point increase in the average SME loan interest rate would increase interest burdens by 500 billion won. This means that SMEs, which are at the center of bad debts, could be directly hit if their interest burden grows.

Although credit ratings for vulnerable companies have recently been downgraded more conservatively reflecting the COVID-19 situation, the number of companies falling into speculative grades has risen to levels comparable to the global financial crisis, signaling another risk. According to Financial Supervisory Service statistics, as of the end of last year, 1,240 companies held credit ratings, of which 1,045 were investment-grade (AAA to BBB), an increase of 33 from the beginning of the year, and 195 were speculative-grade (BB to C), an increase of 76. The proportion of speculative-grade companies rose by 5.2 percentage points from the start of the year to 15.7%, the highest since 16.7% in 2010, right after the global financial crisis.

The self-employed are also in crisis. As of the end of March, outstanding loans to the self-employed reached a record high of 831.8 trillion won, an 18.8% increase from 700 trillion won in the same period last year. This is attributed to a significant rise in self-employed individuals borrowing from banks and others to survive day by day after being hit hard by COVID-19. This growth rate is double the 9.5% increase in household loans during the same period.

A representative from a commercial bank said, "It is questionable whether SMEs and self-employed individuals pushed to the brink can withstand the interest burden caused by rate hikes," adding, "Without support from financial authorities, their burdens could spread throughout the financial sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.