MC Business Withdrawal and Restructuring of Underperforming Units

Focus on Three Core Businesses: Battery, Automotive Electronics, and OLED

Market Cap Increased by 65 Trillion KRW Over 3 Years in Office

Emphasis on Pragmatism Including Streamlined Meetings

Revitalizing Organization by Appointing Young Talent

[Asia Economy Reporter Su-yeon Woo] "The decision to withdraw from the MC (mobile) business division? Internal employees were more surprised than those outside the group."

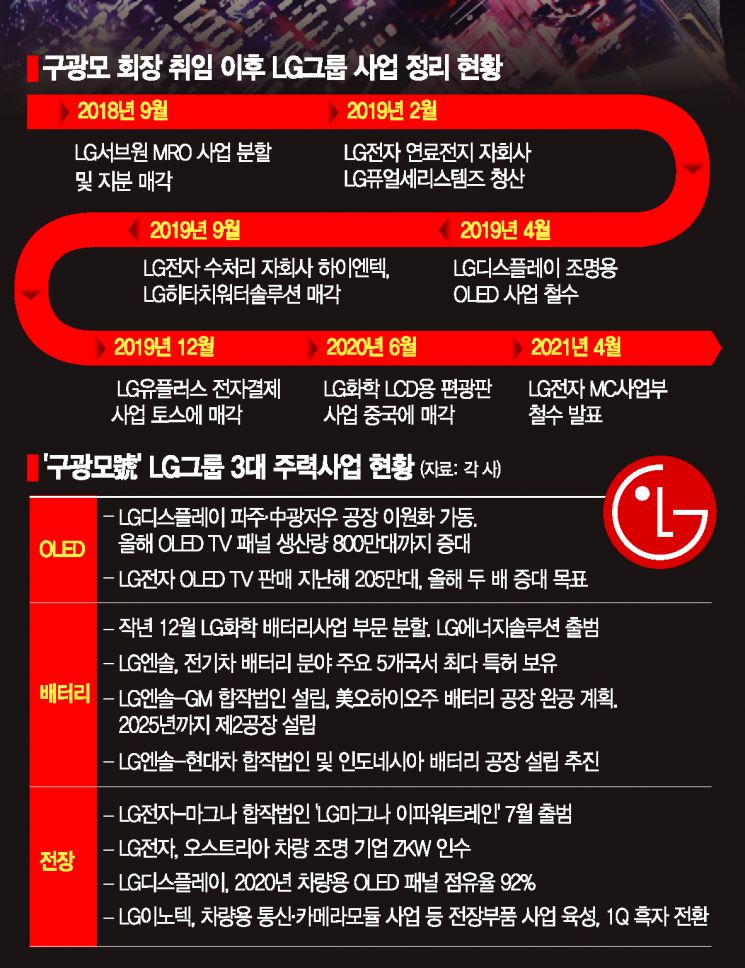

An industry insider who has been with LG Group for nearly 20 years recently shared the atmosphere within LG Group. In April, when LG Electronics officially announced its exit from the mobile phone business, the shock sent to the market was significant. The business restructuring itself was meaningful, but it was especially notable because the conservative and heavy image of LG Group made a firm and swift decision.

The business community interprets that the bold leadership of Koo Kwang-mo, Chairman of LG Group, who will mark his 3rd anniversary on the 29th, was instrumental behind this decision. After completing the business portfolio restructuring and the separation from LX Group, it is expected that Chairman Koo will begin to reveal his distinctive management style in his 4th year in office.

◆Bold Business Restructuring by Cutting Off the ‘Sore Finger’= The MC division of LG Electronics was truly a ‘sore finger’ within LG Group. Although it symbolized the group's persistence in the smartphone business, it recorded losses for 23 consecutive quarters until last year, with a cumulative operating loss reaching 5 trillion KRW. Chairman Koo, who emphasized business restructuring from the beginning of his tenure, made a bold decision based on the big picture of the group.

At the first executive meeting held shortly after his inauguration in August 2018, he conveyed the message, "We will focus more on proactive business portfolio management and talent acquisition." Since then, LG Group has implemented a ‘selection and concentration’ strategy by reorganizing about ten underperforming businesses such as LG Electronics’ water treatment business, LG Display’s lighting OLED business, and LG Uplus’s electronic payment business. This was to slim down the organization and lay the foundation for profitability improvement.

◆‘Battery, Automotive Components, OLED’ Demonstrated Through Stock Price and Performance= Chairman Koo, who boldly reorganized underperforming businesses, focused on three core businesses: battery, automotive components, and OLED. The most outstanding among these is the battery business. LG Energy Solution, leading the battery business within the group, has accelerated business expansion since its spin-off from LG Chem at the end of last year. It is establishing joint ventures with global automakers such as GM and Hyundai Motor Group and is pushing forward with overseas battery plant construction in the U.S. and Indonesia.

In the automotive components sector, LG selected Magna, the world’s third-largest auto parts supplier, as a partner, and an electric vehicle powertrain joint venture is set to launch in July. With combined order backlogs exceeding 220 trillion KRW in battery and automotive components businesses, there is even talk that ‘the next-generation electric vehicles are essentially made by LG Group.’

The OLED TV division has also shown remarkable progress. LG Display has established a two-track production system with plants in Guangzhou, China, and Paju, Korea, planning to increase OLED TV panel production from about 4.5 million units last year to 8 million units this year. LG Electronics, which sells finished products, has set its OLED TV sales target at around 4 million units this year, roughly double last year’s figure.

The focus on these three core businesses has been recognized through stock prices and performance. During Chairman Koo’s three-year tenure, LG Group’s market capitalization increased by about 65 trillion KRW, expanding to 158 trillion KRW by mid-June this year. Sales of four major affiliates?LG Electronics, LG Display, LG Chem, and LG Innotek?increased by 6 trillion KRW compared to the previous year, and a significant growth of about 26 trillion KRW is expected this year.

Koo Kwang-mo, Chairman of LG Group, is visiting LG Science Park in Magok, Gangseo-gu, Seoul, engaging in discussions with employees about new technologies. Photo by LG

Koo Kwang-mo, Chairman of LG Group, is visiting LG Science Park in Magok, Gangseo-gu, Seoul, engaging in discussions with employees about new technologies. Photo by LG

◆Pragmatism Free from Authoritarianism= Upon his inauguration, Chairman Koo asked to be called ‘representative’ to avoid authoritarianism. Instead, he emphasized pragmatism by simplifying various meetings and reports, such as holding online opening ceremonies and reducing the number of attendees at executive meetings.

Additionally, he invigorated the organization by appointing many young and talented personnel through innovative personnel placements. Over the three years since Chairman Koo’s inauguration, the number of newly promoted executives under 45 years old has increased annually in regular personnel evaluations, and the average age of newly appointed senior managers has dropped to 48.

Appointing Kwon Bong-seok, a president-level executive, as CEO of LG Electronics, the group’s flagship affiliate, is also regarded as a groundbreaking move in the industry. Previously, the electronics CEO position was held by a vice chairman-level executive, but now a young president CEO is leading the company, accelerating changes in the organization’s working methods.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.