[Asia Economy Reporter Jeong Hyunjin] As semiconductor manufacturers worldwide expand their production facilities in response to the super boom, construction of 29 large-scale semiconductor factories will begin globally this year and next year. The investment in semiconductor equipment alone is expected to reach 160 trillion won, signaling a significant boom in the semiconductor equipment market.

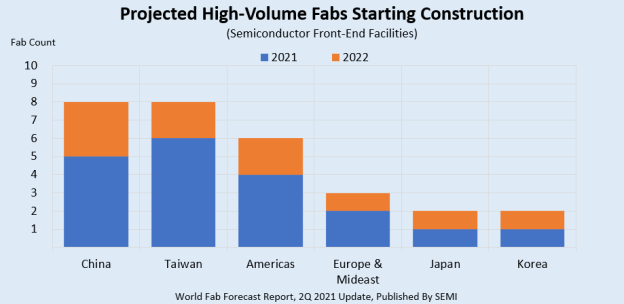

On the 22nd (local time), the Semiconductor Equipment and Materials International (SEMI) analyzed that 19 semiconductor production facilities will start construction this year and 10 next year. By country, China and Taiwan each have 8, the United States 6, Europe and the Middle East a total of 3, and Japan and Korea 2 each.

By sector, foundries are expected to account for the largest share with 15 out of 29. The newly built foundry fabs will vary in monthly production capacity from as low as 30,000 wafers to as high as 220,000 wafers. Memory semiconductor production facilities are expected to be built 4 times over two years, with estimated production volumes ranging from 100,000 to 400,000 wafers per month.

When large-scale semiconductor factories are built, equipment demand also increases significantly. Semiconductor equipment sales, which were about $15.57 billion in the first quarter of last year, rose to $23.6 billion in the first quarter of this year, marking an all-time high. SEMI forecasts that the investment in equipment for the 29 factories scheduled for construction by next year will exceed $140 billion (approximately 159 trillion won) over the coming years.

Since most of the production facilities starting construction this year, equipment is expected to be deployed as early as the first half of next year after groundwork and construction. SEMI stated, "As semiconductor manufacturers announce additional plans to expand production facilities, the number of factories starting construction next year is expected to increase beyond the current figure."

The increase in production facility expansion and equipment investment stems from the growth trend in the semiconductor market, which is experiencing a super cycle. Market research firm IC Insights initially predicted a 12% growth rate earlier this year but revised it upward to 19% in March and recently raised the forecast again to 24%.

Semiconductor manufacturers have already announced production facility expansions this year. Taiwan's TSMC, the number one foundry company, began construction last month on a foundry line factory in Arizona, USA, investing $12 billion. Samsung Electronics also announced plans last month to invest $17 billion in the US to build new and expand foundry factories, currently negotiating with locations including Austin, Texas, where it already has a semiconductor plant, as well as Arizona and New York.

Pat Gelsinger, CEO of Intel, who announced in March plans to build a foundry factory in Arizona, recently stated at a conference, "We plan to announce additional 'mega fabs' to be constructed in the US or Europe within this year." GlobalFoundries, the world's third-largest foundry company, also announced on the same day plans to build a new semiconductor factory in Singapore with an investment exceeding $4 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.