Insurance Retention Rate Over 2 Years Hits 5-Year Low

Dissatisfaction Over Actual Payouts After Cancellation

[Asia Economy Reporter Oh Hyung-gil] As cases of canceling insurance contracts have increased due to economic impacts following COVID-19, consumer complaints about discrepancies between the surrender value quoted by insurance agents and the actual payout amount are also rising. In response, a bill is being promoted to mandate insurance companies to provide guidance so that policyholders can easily check their surrender value at any time.

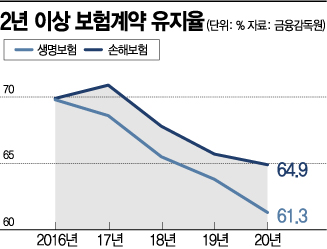

According to the insurance industry on the 22nd, the long-term retention rate of insurance contracts last year, when the COVID-19 crisis occurred, was the lowest in the past five years.

The rate of maintaining insurance contracts for more than two years was 61.3% for life insurance and 64.9% for non-life insurance. These figures represent a decrease of 2.5 percentage points and 0.8 percentage points respectively compared to the previous year.

However, this year there has been an increase in the tendency to maintain insurance rather than cancel it. In the first quarter, the surrender payments made by domestic life insurance companies amounted to 7.4817 trillion KRW, a 3.3% decrease compared to the same period last year. The lapse refunds paid to customers who lost contract effectiveness due to non-payment of premiums for a certain period also decreased by 21.7% to 370.1 billion KRW during the same period.

Furthermore, consumer complaints have significantly increased due to a lack of information about surrender values when canceling insurance.

In particular, since the surrender value is explained by example according to the contract maintenance period, differences arise between the actual amount refunded upon mid-term cancellation and the example, leading to consumer complaints.

Complaints Regarding Insurance Calculation and Payment Reach Over 17,000 Cases

Among the approximately 53,000 complaints related to life and non-life insurance last year, complaints about insurance calculation and payment amounted to 14,188 cases for non-life insurance and 3,713 cases for life insurance.

As dissatisfaction among policyholders rises, the political sphere has also begun efforts to improve this. Lee Jung-moon, a member of the Democratic Party of Korea, has introduced a bill to amend the Insurance Business Act to allow insurance contract holders to easily request information about their surrender value.

Under current law, insurance companies are obligated to prepare insurance guidance materials containing information about surrender values and to provide explanations related to insurance contracts. Although insurance companies provide surrender value example tables in product brochures at the time of subscription, it is common for them to refuse additional requests for materials due to loss or other reasons.

The amendment allows policyholders to request insurance guidance materials from insurance companies until the insurance contract expires or is canceled and its effect is lost. Insurance companies are required to provide the guidance materials by written document, email, phone, text message, or posting on their website unless there is a justifiable reason not to.

Currently, although it varies slightly by company, if the insurance contract holder and beneficiary are the same person, insurance contract information can be checked on the insurance company’s website or call center. Consumers can also check the surrender value by accessing the insurance company’s website directly. However, if the contract holder and beneficiary are different, procedures such as submitting the insurance policy by fax or visiting the customer center with the policy are necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.