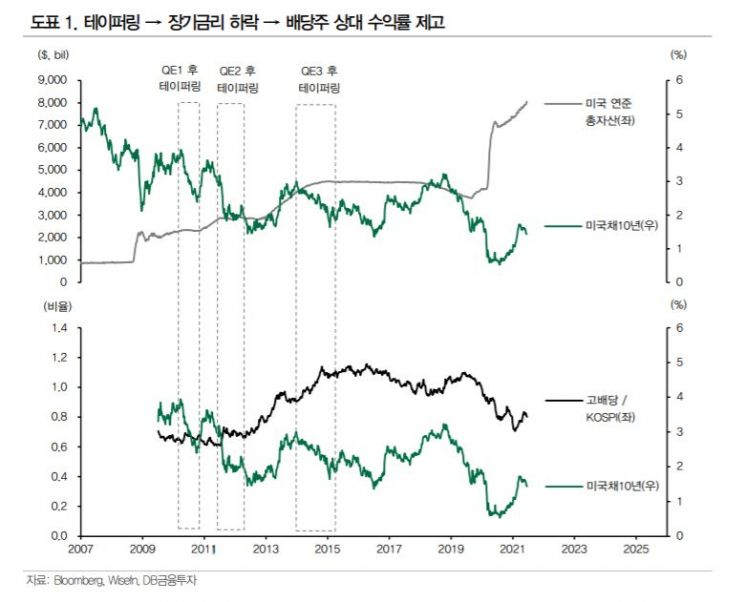

[Asia Economy Reporter Ji Yeon-jin] Advice has emerged to expand dividend stocks in preparation for the U.S. Federal Reserve's (Fed) tapering (reduction of asset purchases). Over the past decade, during the three instances of the U.S. quantitative easing (QE) policy and tapering process, stock market volatility invariably increased, and during this period, high dividend stocks showed higher relative returns.

According to the financial investment industry on the 22nd, during the three periods when the Fed implemented tapering in 2009, 2011, and 2014, the U.S. 10-year Treasury yield showed a downward trend, while the high dividend index relative to the KOSPI drew an upward curve. Hungkuk Securities analyzed the performance of high dividend stocks during periods of more than 100 basis points interest rate increases since 2001 and found that the average absolute return of the high dividend index was 22.7%, and the relative return compared to the KOSPI was -0.4%, which was favorable. Kang Hyun-ki, a researcher at DB Financial Investment, explained, "If the possibility of tapering increases, it is desirable to expand the proportion of stocks that can manage volatility from a portfolio perspective, and among them, focusing on dividend stocks is considered effective," adding, "When tapering occurs, long-term interest rates tend to decline, and during such periods, dividend stocks show characteristics of improved relative returns."

It is also pointed out that high dividend stocks generally perform stronger in the second half of the year than in the first half, making it an opportune time for investment. In particular, in years when the KOSPI recorded negative returns in the second half?2002 (-15.5%), 2008 (-32.9%), 2011 (-13.1%), 2014 (-4.3%), 2015 (-5.4%), and 2018 (-12.3%)?the high dividend index outperformed the KOSPI returns in all cases.

Additionally, the current KOSPI has entered a recovery phase after COVID-19, with earnings forecasts continuously being revised upward. During periods of rising earnings per share (EPS), high dividend stocks have shown outstanding performance. Out of the past 20 years, during 14 instances of KOSPI EPS increases, the high dividend index recorded an average absolute return of 18.2% and an increase probability of 78.6%. Lim Sung-chul, a researcher at Hungkuk Securities, said, "In the first quarter, the net profit of the high dividend index grew by 126% year-on-year, showing a favorable performance compared to the KOSPI," adding, "Since the net profit consensus is also continuously trending upward this year, although the index is rising, a cyclical market without a clear direction is persisting, so the investment attractiveness of high dividend stocks is positive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)