Strengthened DSR and Relaxed LTV Trigger Flood of Customer Inquiries

Banks Find Individual Responses Difficult Due to Complex Details

Confusion Grows as Self-Employed DSR Future Income Reflection Also Proposed

[Asia Economy Reporters Kwangho Lee and Jinho Kim] "They said that with the LTV regulation easing, I could borrow more, but when I ask at the bank counter, I still haven't received any definite answers, so I'm anxious. I've made up my mind to buy my own home, but I'm losing sleep at night worrying that my funding plan might fall apart." (Office worker Mr. A)

Confusion is growing among real demand customers and banks ahead of the full implementation of the government's 'household debt management measures,' including the strengthening of the Debt Service Ratio (DSR) regulation and the easing of the Loan-to-Value (LTV) ratio. Although inquiries from customers eager to realize their 'dream of owning a home' are pouring in, the complexity of the measures makes individual responses difficult. Banks are also reluctant to reflect self-employed individuals' future income in DSR calculations as per financial authorities' guidelines, suggesting that confusion will persist until the system is fully established.

According to the financial sector on the 21st, major commercial banks have begun updating related systems ahead of the household debt management measures taking effect on the 1st of next month, but concerns about confusion have been raised. This is because the current household debt measures are considered stronger and more complex than ever before.

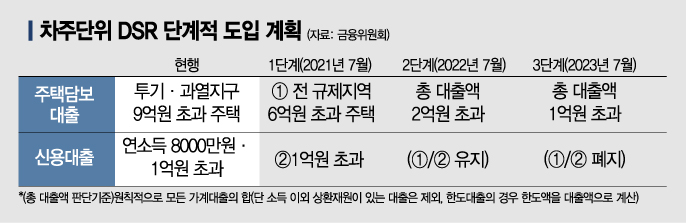

The core of the measures is the 'gradual expansion of the application of DSR 40%.' DSR refers to the ratio of a borrower's annual principal and interest repayment amount on financial debts to their annual income. It reflects the repayment burden of not only mortgage loans but also other loans such as credit loans, earning it the nickname 'the ultimate loan regulation.'

With the strong regulations about to be enforced, frontline bank counters are receiving a continuous stream of customer inquiries about the 'application of DSR 40%.'

A representative from Bank A said, "We are receiving inquiries from customers who expect their loan limits to be significantly reduced due to the DSR regulation," adding, "They mainly ask about the reduced loan limits or ways to secure additional funds."

There are also many inquiries about whether the eased LTV regulation applies. The government raised the LTV preferential margin for non-homeowners from the previous 10 percentage points to 20 percentage points, and customers are asking whether the eligibility for this benefit is based on the 'housing purchase contract date' or the 'loan execution date.' Although financial authorities have stated that the 'loan execution date' is the standard, bank counters reportedly cannot provide clear answers to customers on this matter.

A representative from Bank B said, "Even if there are guidelines for easing regulations, a conservative attitude is inevitable," adding, "If problems arise, responsibility must be borne, so counter responses tend to be passive."

Banks Reluctant to Reflect Self-Employed Future Income in DSR

Meanwhile, financial authorities have expressed their intention to include self-employed individuals, along with low-income and young people, in the scope of future income recognition, leaving banks frustrated.

For self-employed individuals, there is a lack of appropriate statistical data, and income varies greatly depending on the industry, making it difficult to predict future income.

A representative from Bank C explained, "Young people who become salaried workers can have their future income predicted as their salary will increase over time, but it is impossible to predict how the future income of self-employed individuals will change." He added, "This issue was discussed in meetings with financial authorities, but all banks expressed reluctance," and "Because it is a profession with limitations in predicting future income, it will not be easy."

However, financial authorities plan to estimate income for groups with difficulty in income verification by using financial income, savings amounts, credit card usage, and national pension payment records, so self-employed individuals may benefit from these data when determining loan limits.

The financial authorities plan to gather banks' opinions and finalize the policy.

Professor Tae-yoon Sung of Yonsei University's Department of Economics pointed out, "In finance, there is no choice but to approach people with stable future income differently from those without," adding, "It is not right to say that everyone should be given benefits just because they cannot receive them, and support for unstable people only destabilizes the financial market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.