Kim Jin-pyo, Chairman of the Real Estate Special Committee of the Democratic Party of Korea, is announcing additional supply measures to stabilize the housing market at the National Assembly Communication Center on the 10th.

Kim Jin-pyo, Chairman of the Real Estate Special Committee of the Democratic Party of Korea, is announcing additional supply measures to stabilize the housing market at the National Assembly Communication Center on the 10th. [Photo by Yoon Dong-joo]

[Asia Economy Reporter Ryu Tae-min] The government and the ruling party are rushing to introduce new forms of housing supply plans. As housing prices soar to unprecedented levels, the main focus is on lowering the threshold so that non-homeowners can secure their own homes by initially paying only a portion of the housing price. However, concerns about feasibility arise due to low profitability and the fact that residents cannot avoid the burden of monthly rent.

‘Anyone’s Home’: Buying at the initial sale price after 10 years of occupancy

The Democratic Party’s Special Committee on Real Estate announced the ‘Anyone’s Home’ project on the 10th and selected pilot sites. The ‘Anyone’s Home’ program, supplied through a public-supported private rental model, allows non-homeowners, youth, and newlyweds who lack initial capital to pay 6-16% of the housing price upfront and then live by paying rent at 80-85% of market prices for 10 years. After fulfilling the mandatory 10-year residency period, residents can purchase the home at the sale price calculated at the time of initial occupancy 10 years earlier. The Democratic Party plans to supply 10,785 units across six locations: Incheon, Ansan, Hwaseong, Uiwang, Paju, and Siheung.

Unlike existing public rental or public rental-New Stay models where the developer took the capital gains from market price increases upon conversion to ownership after 10 years, ‘Anyone’s Home’ allows the developer to take only a 10% appropriate development profit, with the remaining capital gains going to the residents. For example, for a 500 million KRW home, the resident pays 16% of the sale price upfront (80 million KRW), moves in, and pays monthly rent at about 80% of the surrounding market price for 10 years. Then, upon conversion, the resident pays the initial sale price of 500 million KRW to complete ownership. The mandatory rental period is 10 years.

‘Equity Accumulation Sale Housing’: Buying your home over 20-30 years

The Ministry of Land, Infrastructure and Transport and Seoul City announced that they will publicly notify the amendment to the Enforcement Decree of the Public Housing Special Act, which specifies the details of equity accumulation sale housing, from June 11 to July 13.

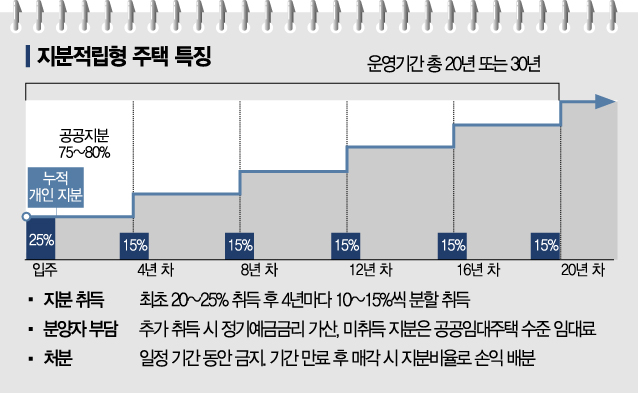

Equity accumulation sale housing allows buyers of public sale apartments to initially pay 10-25% of the sale price and move in, acquiring only partial equity. Over a period exceeding 20 years, residents gradually purchase the remaining 75-90% equity. The core idea is to buy 10-15% of the housing equity every four years so that full ownership is achieved after 20-30 years.

For example, for a 500 million KRW apartment, the resident pays 25% of the sale price (125 million KRW) at move-in. The remaining 375 million KRW is paid in installments every four years, reaching 100% equity ownership after 20 years. Until full equity is acquired, residents pay rent. However, there is a 10-year resale restriction and a 5-year mandatory residency period.

Low profitability and high resident burden... feasibility ‘questionable’

Both housing types are positively evaluated for attempting to supply housing affordably. Song Seung-hyun, CEO of Urban and Economy, said, “With housing prices rising so much and loan regulations tightened as they are now, it is generally difficult for non-homeowners to secure their own homes,” adding, “The introduction is positive in that it lowers the initial financial burden and breaks down entry barriers.”

However, the problem lies in low feasibility. For equity accumulation sale housing, capital gains can only be realized proportionally to the equity held, and for ‘Anyone’s Home,’ the developer takes only 10% of the profit, with the rest going to the residents. Therefore, from the developer’s perspective, profitability is low, which may make it difficult to secure sufficient supply as planned.

Equity accumulation sale housing also burdens residents because even if they prepare a lump sum, they cannot buy all equity at once and thus cannot avoid monthly rent. Additionally, the ‘Anyone’s Home’ project faces criticism that if housing prices rise significantly after 10 years when conversion occurs, it could lead to ‘lottery subscription’ controversies, and conversely, if prices fall sharply, residents might refuse to purchase, causing unsold units.

CEO Song said, “The candidate areas have good locations and residents’ financial burdens are reduced, so the potential for success seems high,” but added, “However, if profitability is low and developers face heavy burdens, smooth supply will be difficult, lowering feasibility.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)