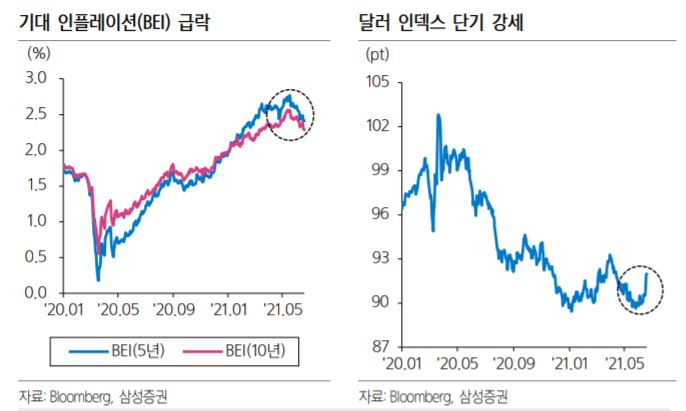

[Asia Economy Reporter Ji Yeon-jin] Recently, growth stocks have been showing strength in the domestic stock market. Kakao has risen to the 3rd place in KOSPI market capitalization, which is interpreted as the decline in expected inflation following the U.S. Federal Open Market Committee (FOMC) has stimulated investor sentiment toward growth stocks.

According to the financial investment industry on the 20th, there has been a recent shift from value stocks to growth stocks. While growth stocks, which had stalled due to inflation concerns, have been rising again this month, the performance of economically sensitive stocks such as materials and industrials has been sluggish.

Industry experts point out that rather than a dichotomy between growth and value stocks, it is important to first understand the absolute level of the current stock price relative to the company's intrinsic value and earnings. Shin Seung-jin, a researcher at Samsung Securities, said, "Good companies do not always guarantee good investment performance," adding, "Rather than chasing the rapidly rising growth stocks, it would be better to respond with sectors such as automobiles and secondary batteries, where the stock price increase relative to growth is not yet high, as well as media, entertainment, and duty-free sectors that can benefit from the resumption of economic activities."

Some expect that since the market has not fully recovered its risk appetite, growth stocks with solid cash flows such as internet, media, leisure, and secondary batteries will be chosen first, but from this summer, growth stocks with more distant cash flows will emerge as leading stocks.

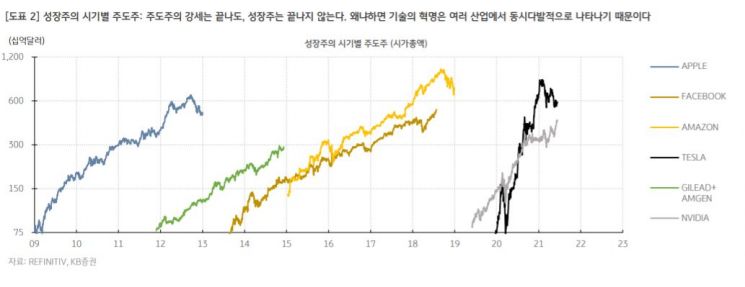

Lee Eun-taek, a researcher at KB Securities, said, "Regarding growth stocks, I often get asked, ‘How much further can growth stocks go from here?’" He added, "Similar debates have occurred in the U.S., but despite that, the growth stock rally has continued for over 10 years." He explained, "When people thought ‘Apple’ had peaked, ‘bio’ emerged; when ‘bio’ was thought to have peaked, ‘Amazon and Facebook’ appeared; and when FANG was considered to have peaked, ‘Tesla and Nvidia’ emerged," adding, "The reason is that technological revolutions occur simultaneously across multiple industries, not just in one."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.