Increase of Youth Customized Jeonwolse Support Limit to 100 Million Won

[Asia Economy Reporter Jin-ho Kim] Starting from the 1st of next month, a 40-year ultra-long-term policy mortgage product will be introduced, and the per household limit for the Bogeumjari Loan will be increased from the existing 300 million KRW to 360 million KRW. Additionally, the support limit for the 'Youth Customized Jeonse and Monthly Rent Loan' for homeless youth such as university students will also be raised to 100 million KRW.

The Financial Services Commission announced follow-up measures on the 20th based on these contents as part of the 'Financial Support Plan for Low-income and Actual Demanders.'

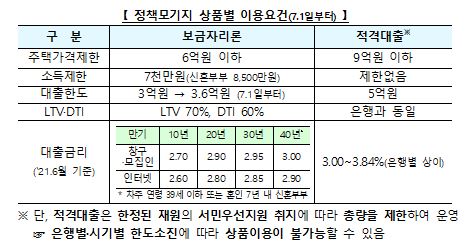

First, a '40-year maturity' policy mortgage will be introduced for youth aged 39 or younger and newlywed couples within 7 years of marriage. The target products are the Bogeumjari Loan and Qualified Loan products. The aim is to extend the maturity for youth households with limited income to reduce the monthly principal and interest repayment burden. For a 300 million KRW loan, the principal and interest repayment amount for a 30-year maturity is 1,241,000 KRW, but if extended to 40 years, it decreases to 1,057,000 KRW.

The loan limit for the Bogeumjari Loan will be expanded from the existing 300 million KRW to 360 million KRW. The Bogeumjari Loan is a fixed-rate mortgage loan provided to households with house prices below 600 million KRW and annual income below 70 million KRW, with about 170,000 households using it annually.

The youth Jeonse and monthly rent loan will be expanded, and the guarantee fee for Jeonse loans will also be reduced. The limit will be raised by 30 million KRW from the existing 70 million KRW to 100 million KRW. The financial authorities expect that about 5,000 additional youths will benefit annually due to the increase in the loan limit.

The minimum guarantee fee applied to youth customized Jeonse and monthly rent loans and special guarantees for vulnerable groups will be lowered from 0.05% to 0.02%. The overall guarantee fees for Jeonse loans and Jeonse deposit return guarantees will also be reduced.

A Financial Services Commission official stated, "The system improvements will apply to loan applications from July 1," and added, "Regarding the ultra-long-term mortgage products, we will review various measures in the second half of the year to enable their introduction in the private sector as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.