[Asia Economy Reporter Kiho Sung] The government’s debt refinancing (loan switching) platform, set to launch in October, is currently gathering opinions from various sectors to refine the service. However, there are concerns that the service usage hours will be limited to bank business hours as currently planned, indicating a need for improvement. Additionally, conflicts are expected before the implementation of the debt refinancing service due to clear differences in interests between financial companies and the platform providers regarding fees.

According to the financial sector on the 20th, the Korea Financial Telecommunications & Clearings Institute held a briefing session on the debt refinancing platform on the 10th with 12 private companies (Finda, Viva Republica, NHN Payco, Rainist, Fink, MyBank, Pinset, Fintech, TeamWink, Pinmart, Kakao Pay, SK Planet) and four related associations (Korea Federation of Banks, Korea Inclusive Finance Agency, Korea Credit Finance Association, Fintech Industry Association).

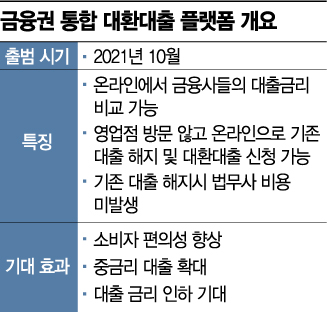

According to the roadmap revealed at the briefing, participation will begin with banks in October, followed by secondary financial institutions such as savings banks and capital companies in December, with all parties expected to join by early next year at the latest. The pilot operation will start in October, with full-scale operation commencing in the first half of next year. Once the platform is established, consumers will be able to compare loan conditions from various financial institutions and freely switch to other loans. Information such as individual financial institutions’ loan terms and interest rates will be disclosed, leading to intense competition within the financial sector.

However, opinions between existing financial institutions and platform providers have already diverged before the service launch. The most controversial issue is the service usage hours of the debt refinancing platform. During the pilot operation starting in October, the service is planned to operate from 9 a.m. to 4 p.m. and only on bank business days.

Companies preparing the debt refinancing platform are concerned that limiting service hours to bank business hours will reduce consumer participation. Since it is a non-face-to-face service, they argue that it should be available 24 hours a day for consumer convenience. On the other hand, banks have reportedly requested that the service be limited to business hours due to security and interest-related issues. The financial authorities plan to operate the service only during bank business hours during the pilot period and then reconsider the schedule afterward.

A fintech company official said, "The success or failure of the debt refinancing platform service will depend on initial usage rates," adding, "Operating the service based on branch office hours, while bank online services are available 24/7, could hinder the activation of the debt refinancing platform, considering the working hours of office workers and others."

Fees remain a contentious issue. The core concern is the fee rate between financial companies and the platform providers facilitating the loan switching. Frequent loan transfers could increase intermediary fees for platform providers. Early repayment fees are also under discussion. If financial companies set high early repayment fees, switching loans itself becomes difficult. There are opinions that early repayment fees should be set at an appropriate level to promote service activation.

Meanwhile, Naver Financial, which is known to be participating in the debt refinancing platform, stated that no final decision has been made. Naver Financial is currently conducting internal discussions regarding participation and did not attend the recent briefing session.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)