[Asia Economy Reporter Minji Lee] TechnipFMC is expected to see an upward trend in performance as project sites delayed due to the impact of COVID-19 and new project contracts resume.

Looking at TechnipFMC's stock price on the 19th, it rose about 27% from $6.89 to $8.74 since the beginning of this year. Although it has not recovered to the pre-COVID-19 level of $11 (February last year), it is predicted to show an upward trend this year as marine-related projects resume.

TechnipFMC is an EPC (Engineering, Procurement, Construction) company that provides integrated solutions throughout the entire project cycle from basic design to installation of marine-related projects. It consists of the Subsea business division, which designs and constructs subsea infrastructure, and the Surface business division, which builds and constructs coastal infrastructure. TechnipFMC has expanded its global market position by ranking 11th in 2019 and 10th in 2020 in the global engineering rankings selected by ENR, a weekly construction and engineering magazine.

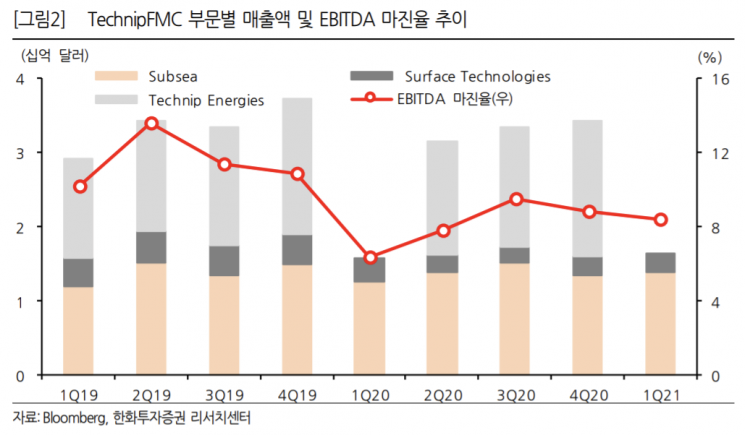

Technip's first-quarter sales amounted to $1.63 billion, an increase of 3.1% compared to the same period last year. The adjusted EBITDA margin rose 5.1 percentage points to 10.1% during the same period. Despite the off-season for installations in the first quarter, high project progress in the Subsea division led to revenue recognition, driving overall sales growth. The adjusted EBITDA margin improved due to cost reductions initiated by the impact of COVID-19 and organizational restructuring caused by the personnel split of the Technip engineer business division.

Researcher Yoorim Song of Hanwha Investment & Securities explained, “From the second quarter, the seasonal peak season begins, and as we move away from COVID-19, additional new project orders deferred by clients will be added, showing a phase where shareholder balance and sales recover simultaneously this year and next year.”

Entry into the energy transition business is also positive. The company is entering the energy transition business based on capabilities accumulated from past traditional marine projects. The company’s Deep Purple technology can provide integrated solutions for energy generation, storage, and transmission of seawater surface and subsea infrastructure, and can be specialized for offshore wind and tidal resource development facilities. Researcher Song stated, “Recently, we established strategic partnerships with wind power developer Magnora and wind and tidal developer Bombora, and plan to announce development plans for wind power complexes in the North Sea of Norway and Scotland within this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)