US Holds Interest Rates Steady

But Outlook for Future Rate Hikes Moves Earlier and Tapering Discussions Begin

South Korea Also Weighs Rate Hikes Within the Year Due to Financial Stability

Minority Opinions on Rate Hikes May Emerge as Early as This Summer

[Asia Economy Reporter Kim Eunbyeol] Since the COVID-19 pandemic, the global trend of "unprecedented money printing" is gradually showing signs of normalization. As COVID-19 vaccines are rapidly distributed, the economic recovery is overheating, and with funds flowing into real estate, stocks, and cryptocurrencies, the gap between the real economy and finance is widening, prompting central banks around the world to gradually withdraw the money they had injected.

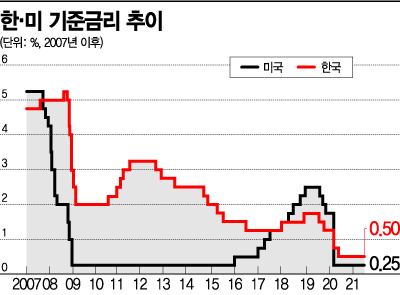

On the 16th (local time), the U.S. Federal Reserve (Fed) held its regular Federal Open Market Committee (FOMC) meeting and decided to keep the benchmark interest rate (federal funds rate) unchanged at 0.00?0.25%. This means maintaining the zero-level benchmark interest rate set after COVID-19.

However, the Fed assessed the recent economic situation more positively than before. In its statement, the Fed said, "As COVID-19 vaccinations increase, the pandemic's impact on the economy is expected to diminish." The phrase from the previous statement describing the pandemic as causing "enormous human and economic hardship" was removed. This positive economic assessment implies a higher likelihood of gradually withdrawing the measures implemented in response to COVID-19.

FOMC members also advanced their forecast for the timing of future rate hikes by about a year. In the Fed's dot plot, which shows FOMC members' future rate projections, two rate hikes are expected in 2023. This is an advancement compared to the previous stance of maintaining zero interest rates until 2023. Among the 18 FOMC members, 13 anticipated that the Fed would raise rates in 2023.

The International Finance Center stated, "With the FOMC as a turning point, the Fed is entering a phase of monetary policy normalization, and long-term interest rates are expected to rise. Given the uncertainty in the inflation path, volatility may increase and there is a possibility of sharp spikes." The center noted that although the FOMC announcement was somewhat hawkish (favoring monetary tightening), it is unlikely to trigger a tantrum because the Fed has maintained sufficient communication with the market.

The Bank of Korea (BOK) also evaluated the FOMC results as "more hawkish than expected." The BOK had already expressed intentions to raise rates several times within the year. South Korea's benchmark interest rate is at a historic low of 0.50% per annum, the economy is recovering, and financial stability issues such as a sharp rise in real estate prices have become significant. If the U.S. tightens monetary policy earlier, the reasons for the BOK to raise rates increase further.

BOK Monetary Policy Board members are also showing increasingly hawkish tendencies. According to the minutes of the Monetary Policy Board meeting held on the 27th of last month, several members argued for adjusting the current accommodative monetary policy stance, citing the recent rapid economic recovery, rising inflation trends, a surge in household debt, and worsening financial imbalances. Since about half of the members called for monetary policy normalization, there is speculation that the pace of the BOK's rate hikes could be faster than expected.

One Monetary Policy Board member stated in the minutes, "If the current accommodative financial conditions persist, the negative effects on growth are expected to increase in the medium to long term due to consumption constraints caused by rising debt and decreased efficiency in resource allocation, rather than short-term economic stimulus effects." Another member said, "The accommodative financial conditions created in response to last year's COVID-19 crisis are now contributing to increased financial market instability. Considering the strengthening recovery of the domestic economy and the expanding risks to financial stability, it is necessary to consider partial adjustments to the unusually accommodative monetary policy stance."

Global investment bank JP Morgan indicated that minority opinions favoring rate hikes could emerge at the BOK Monetary Policy Board meetings in July or August. In the securities industry and elsewhere, it is expected that the BOK will raise rates in October or November, but even if actual rate hikes do not occur this summer, minority opinions are expected to begin appearing and discussions will intensify.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.