Savings Bank Loan Balance Stagnates, Capital Companies Shrink

Some Say "Uncertainty Arises if Sale Process Becomes Visible"

JT Savings Bank Says "Difficult to See Impact from Sale Case"

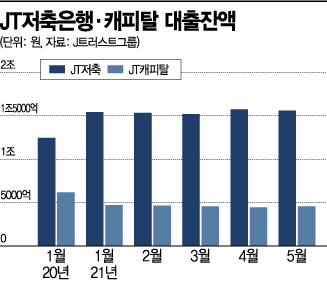

[Asia Economy Reporter Song Seung-seop] The sale process of JT Savings Bank and JT Capital has been delayed beyond the planned schedule, and it has been identified that the loan balances of the two financial companies have either stagnated or contracted. There is also an analysis that the sale process has affected loan growth amid a booming savings bank industry.

According to the Japanese financial group J Trust on the 21st, the loan balance of JT Savings Bank last month was 1.5586 trillion KRW, down 13.3 billion KRW from 1.5719 trillion KRW the previous month. Compared to 1.5417 trillion KRW at the beginning of this year, it only increased by 16.9 billion KRW, showing sluggish growth.

In the case of JT Capital, the contraction trend is clear. The group revealed that JT Capital’s "operating loan balance" was 454.2 billion KRW last month, down from 470.2 billion KRW at the beginning of the year. This marks 15 consecutive months of shrinking loan size. Compared to 617.3 billion KRW in January last year, it decreased by 163.1 billion KRW (26.4%).

Stagnant Loan Growth Possibly Influenced by Sale Process

Accordingly, there is an interpretation that the ongoing sale process of the two financial companies by J Trust has had some impact. Especially in the savings bank industry, where loan sizes are rapidly increasing, this observation is considered plausible. Professor Kim Dae-jong of the Department of Business Administration at Sejong University said, "In the past, the financial industry took measures to prevent existing customers from leaving as the sale process became visible," adding, "Since the trustworthiness of the new owner after the sale is unknown and there is uncertainty about what financial policies will be implemented, there will likely be negative effects."

JT Savings Bank stated that it is difficult to directly link the eased loan growth to the sale attempt. The reason is that the sale does not significantly affect financial consumers. A JT Savings Bank official explained, "Consumers do not primarily consider the sale when choosing loans," and added, "The loan balance reflects various circumstances such as managing the loan-to-deposit ratio."

The parent company of JT Savings Bank and JT Capital, J Trust Group, is currently attempting to sell the two domestic financial companies to VI Financial Investment, a Hong Kong-based private equity fund. JT Capital was supposed to be sold first, but the payment delay has postponed the process.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)