New Jeonse Listings Keep Decreasing

Jeonse Price Increase Rate Rises for 3 Consecutive Weeks ↑

Price Difference in Same Complex Sometimes Doubles

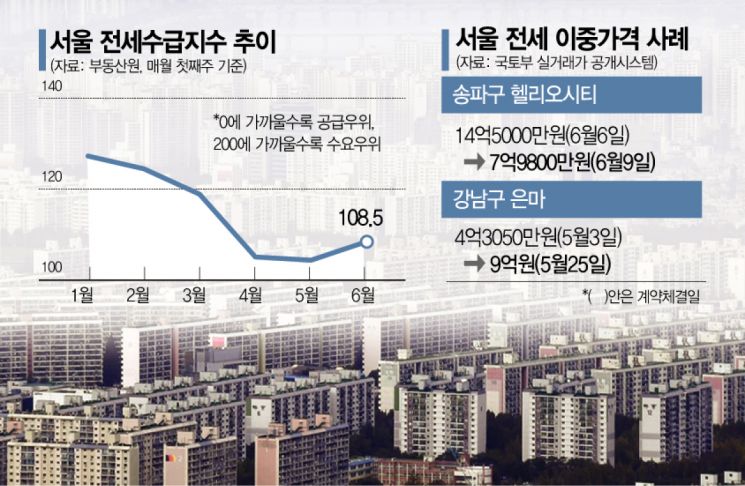

[Asia Economy Reporter Kim Hyemin] The Seoul jeonse market, which seemed to have stabilized, has recently shown unusual trends. The supply and demand have become unstable, causing the jeonse price increase to widen for three consecutive weeks. Due to the so-called ‘Lease 3 Acts,’ it is difficult to find new jeonse listings, and the phenomenon of ‘dual pricing,’ where jeonse prices in the same apartment nearly double, is intensifying.

According to the time series statistics from the Korea Real Estate Board on the 15th, the jeonse supply-demand index in Seoul for the first week of June rose to 108.5, up from 107 the previous week. The index, which had been declining since the beginning of the year, rebounded from the fourth week of last month and has been increasing for three consecutive weeks. The index indicates that the closer it is to 0, the more suppliers there are, and the closer it is to 200, the more demanders there are. This means that the number of people looking for jeonse is increasing compared to the listings available on the market.

Jeonse prices are also rising. As of the first week of June, the apartment jeonse price in Seoul increased by 0.08% compared to the previous week. The jeonse price increase rate fell from 0.13% at the beginning of the year to 0.3% in mid-last month but has recently expanded for three consecutive weeks from 0.04% to 0.06% and then 0.08%.

This is largely due to the full-scale relocation of reconstruction apartments in Banpo-dong, Seocho-gu. In fact, the jeonse price fluctuation rate in Seocho-gu was only about 0.01% until early last month but surged to 0.16% in mid-May and then rose significantly to 0.26% and 0.39%. Due to the relocation demand, jeonse prices in the southeastern areas such as Gangnam, Songpa, and Gangdong-gu, as well as Dongjak, Yongsan, and Seongdong-gu, are also showing strong trends.

This instability in the jeonse market is expected to persist in the second half of the year. The so-called ‘Lease 3 Acts,’ including the jeonse and monthly rent cap system, the right to request contract renewal, and the jeonse and monthly rent reporting system, have been fully implemented, causing new supply to shrink. Additionally, as multi-homeowners are moving to convert jeonse to monthly rent to alleviate holding tax burdens, the number of new jeonse listings is likely to decrease further in the second half. With the practical abolition of the private rental business system, listings for villas and multi-family houses may also decline.

According to the Seoul Real Estate Information Plaza, jeonse transactions, which exceeded 10,000 in January this year, decreased to 7,094 last month. The number of Seoul apartment jeonse listings on the real estate big data platform Apartment Real Transaction (Asil) also dropped by 4.8%, from 22,024 on the 15th of last month to 20,958 a month later. Meanwhile, monthly rent listings only decreased by 300 (2.2%) during the same period.

Meanwhile, due to the impact of the Lease 3 Acts, as new jeonse prices rise, the dual pricing phenomenon, where jeonse prices differ significantly for the same area within the same apartment, is becoming entrenched. For example, two jeonse contracts for 99.6㎡ (exclusive area) at Helio City in Garak-dong, Songpa-gu, were signed within just three days with a price difference of about 600 million KRW. Similarly, at Eunma Apartment (exclusive area 84.43㎡) in Daechi-dong, Gangnam-gu, a jeonse contract was signed for 430.5 million KRW on the 3rd of last month, but another contract was signed for 900 million KRW on the 25th of the same month. This means that jeonse prices for the same apartment and the same area nearly doubled.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)