Major Commercial Banks Reluctant to Partner with Real-Name Accounts Amid Exemption Criteria Discussions

Possibility of 'Secondary Boycott' on Cryptocurrency Money Laundering in Major Countries Including the US

Basel Committee: "Cryptocurrency Poses Risks to Banks Due to Money Laundering and Terrorist Financing"

[Asia Economy Reporter Kim Jin-ho] Discussions on 'exemption criteria' for incidents such as money laundering to assist banks in issuing real-name accounts for cryptocurrency exchanges have begun, but doubts about their effectiveness are being raised. This is because even if domestic financial authorities' sanctions are avoided, the possibility of facing severe penalties from major overseas countries such as the United States remains. The most concerning issue is the potential emergence of a 'secondary boycott' if money laundering incidents related to countries sanctioned by the U.S., such as North Korea and Iran, occur.

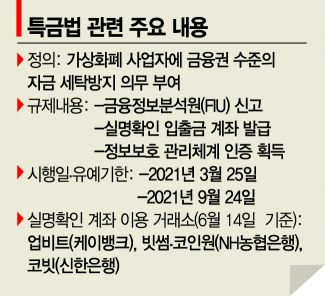

According to the financial sector on the 14th, some commercial banks and the Korea Federation of Banks have participated or are preparing to participate in a dedicated task force (TF) for cryptocurrency exchanges, which includes related agencies of the Financial Services Commission. The banking sector plans to focus discussions with authorities on legal issues related to issuing real-name accounts for cryptocurrency exchanges through the TF. It is known that they have already conveyed to the authorities the need for 'exemption criteria' concerning incidents such as money laundering.

However, even if 'exemption criteria' are established, it is uncertain whether they will be effective. This is because major overseas countries, including the U.S., are highly sensitive to money laundering incidents. Even if exemption criteria are prepared through the TF, they will only apply domestically and cannot serve as a means to avoid sanctions from foreign governments or financial authorities.

Many commercial banks that have not formed real-name account partnerships are most concerned about this issue. They are particularly sensitive to the fact that money laundering incidents related to cryptocurrency could potentially trigger a 'secondary boycott' issue. A 'secondary boycott' refers to the sanctioning of third-country companies or financial institutions that conduct transactions with countries sanctioned by the U.S.

Financial institutions that violate this face sanctions such as asset freezes within the U.S. and blocked access to the U.S. financial network. Being blocked from accessing the U.S. financial network means they cannot conduct dollar transactions. For banks, this is essentially a death sentence. A commercial bank official said, "It is clear that the disadvantages far outweigh the benefits if we partner with cryptocurrency exchanges," adding, "If any problem arises and we are unable to conduct dollar transactions, it would inevitably lead to bankruptcy, which is an enormous risk."

In fact, in the past, Industrial Bank of Korea paid a fine of 104.9 billion won to the U.S. Department of Justice and the New York State Department of Financial Services for violating Iran sanctions related to money laundering. Banco Delta Asia in Macau, which was involved in transactions with North Korea, went bankrupt due to the U.S. secondary boycott.

The Basel Committee on Banking Supervision (Basel Committee), which sets global financial supervisory standards and discusses issues among supervisory authorities, recently classified cryptocurrency as the highest-risk asset, further casting doubt on the appropriateness of establishing 'exemption criteria.' The Basel Committee expressed strong concerns about the extreme price volatility of cryptocurrencies and their use in illicit transactions. It pointed out that cryptocurrencies are exploited for money laundering and supporting terrorist organizations, putting banks at risk.

A financial sector official said, "Considering the Basel Committee's position strongly urging stricter cryptocurrency regulations, it seems difficult to expect financial authorities to actively establish exemption criteria."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.