US Fed Likely to Prioritize Employment Over Inflation Unless Price Surge Persists

Employment Indicators Remain Weak, Suggesting More Time for US Tightening

[Asia Economy Reporter Eunbyeol Kim] Despite the U.S. consumer price inflation rate rising more than expected, the market impact has been limited, prompting experts to offer various interpretations. Although inflation was higher than anticipated, the stock market has actually risen, and market interest rates have fallen (bond prices have risen), showing trends contrary to the usual expectations. It is interpreted that although inflation surged in May, it was at the expected level, and due to the base effect from last year's COVID-19 crisis, there is optimism that inflation will stabilize from the second half of the year.

On the 14th, the International Finance Center released a report titled "Reasons for Limited Market Impact Despite Continued Strength in U.S. Consumer Price Index (CPI)," stating, "Although the U.S. CPI showed strength for two consecutive months, the financial market response was limited," and evaluated that "market participants largely accept the view that the inflation surge is temporary and have accepted the Federal Reserve's (Fed) policy framework shift that prioritizes employment over inflation."

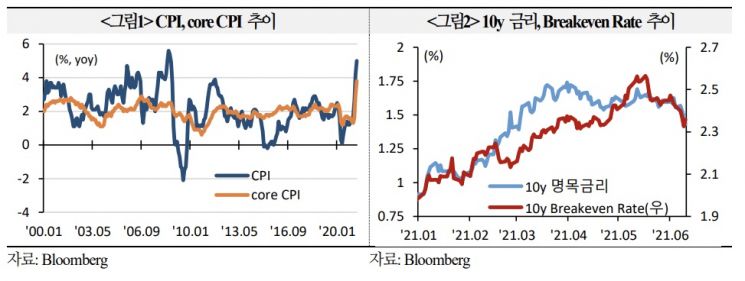

In May, the U.S. CPI rose 0.6% month-on-month and 5.0% year-on-year, significantly exceeding expectations. The U.S. 10-year Treasury yield initially rose about 3 basis points (1bp = 0.01 percentage points) immediately after the CPI announcement but then fell to 1.43%, the lowest level since early March. It is currently moving around 1.46%. The 10-year Breakeven Inflation (BEI) also dropped from 2.56% on the 17th of last month to the 2.35% range. The 10-year Korean government bond yield is also around 2.094%, showing no significant rise above the 2% level. The KOSPI index continues its upward trend.

Kim Sung-taek, head of the Global Economy Department at the International Finance Center, said, "As seen in the weakness of the BEI, the recent financial market generally accepts the Fed's assessment that inflation caused by demand-supply mismatches is temporary and somewhat lowers the possibility that the inflation trend will be persistent." Bloomberg reported that investors who had sold government bonds expecting inflation have closed their short positions.

Domestic market experts also explained that the perception that the May inflation rate has effectively peaked on an annual basis is reflected. Gong Dong-rak, a researcher at Daishin Securities, said that while the absolute value of future inflation data may still be considerable, there is an expectation that it will be lower than in May. The BEI, which reflects market expectations of future inflation trends in the bond market, showed signs of decline since mid-May. This could be a preemptive reaction to the theory of a May inflation peak formed after the April inflation shock.

Looking at inflation indicators by item, the fact that only some items surged supports the argument that the inflation rebound is temporary. Excluding highly volatile items among the components of the inflation index, prices still do not deviate significantly from a limited range. A representative example is the price of used cars and trucks, which explains about half of the core CPI increase, rising 7.3% month-on-month. Clothing (1.2%) and transportation services (1.5%) also showed steady increases.

The International Finance Center stated, "Although inflation indicators surged, the market is responding calmly, so attention should be paid to how the Fed will present its future policy path at this month's Federal Open Market Committee (FOMC) meeting." It added, "Unless the perception spreads that the inflation surge could become a persistent phenomenon due to instability in inflation expectations, the likelihood of the Fed shifting its policy focus from employment to inflation is slim."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)