[Asia Economy Reporter Seulgina Jo] "The main game has not even started."

The conflict between CJ ENM and LG Uplus over content usage fees has ultimately led to user damage with the 'broadcast suspension' of U+ Mobile TV, raising concerns inside and outside the industry that "this is just the beginning of the main game." KT Season is currently negotiating with CJ ENM, and negotiations over IPTV program usage fees, which have far more subscribers than online video services (OTT), are also facing difficulties. Last year's cable TV (D'Live) blackout crisis, which was barely resolved, is now escalating across the industry including OTT and IPTV.

◆ Intensifying Conflict over ‘Content Usage Fees’

According to related industry sources on the 14th, CJ ENM stopped real-time broadcasting of 10 channels including tvN and Mnet on U+ Mobile TV from midnight on the 12th. This is the first case where the conflict over content usage fees between the telecom company and CJ ENM exceeded the negotiation deadline and led to a broadcast suspension.

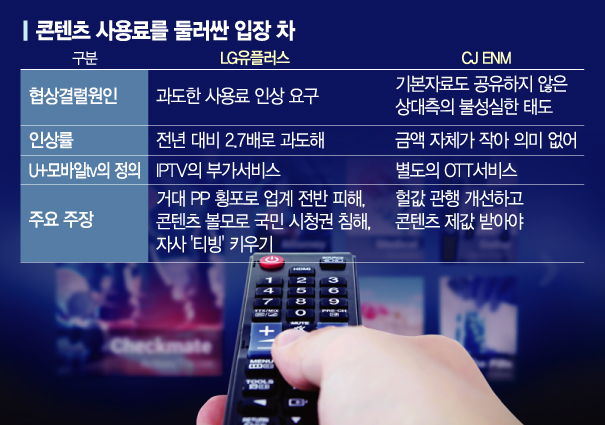

Since then, both companies have continued a war of words, blaming each other for the breakdown of negotiations. LG Uplus claimed that "excessive fee demands caused the negotiation failure," while CJ ENM immediately rebutted, saying "LG Uplus did not even share basic data such as subscriber numbers." CJ ENM's position is that the amount received as content fees so far has been small, so the rate of increase is not significant. This year, the content usage fee CJ ENM requested from LG Uplus for U+ Mobile TV was confirmed to be 2.7 times higher than the previous year, which corresponds to a 175% increase.

The problem is that broadcast suspensions could occur on other channels such as KT Season. KT, which operates the OTT Season, is also reluctant to accept CJ ENM's demand for a '1000% increase compared to the previous year.'

This conflict is also evident in IPTV negotiations, which are proceeding separately from OTT. Currently, CJ ENM is demanding a 25% increase, while the three IPTV companies (KT, LG Uplus, SK Broadband) maintain that they cannot accept it. Public accusations such as "stingy" and "full of arrogance and greed" have been exchanged during this process, raising the possibility of the worst-case scenario. Inside and outside the telecom industry, it is believed that CJ ENM first notified the suspension of U+ Mobile TV broadcasting, which is not subject to the Broadcasting Act, to gain an advantage in IPTV program usage fee negotiations. The two sides have also failed to find common ground over the ‘mobile IPTV’ service that allows IPTV viewing on portable devices such as tablet PCs.

LG Uplus criticized, "Insisting on excessive fee increases is a strategy to secure a large number of subscribers by broadcasting content only on its own OTT ‘TVING’ if the demands are not accepted," adding, "CJ ENM’s unilateral fee increase demands, relying on content competitiveness, are expected to have a negative impact on the domestic media industry." The Korea Small Broadcasting Channel Association also argued, "The tyranny of large PP demanding high rate increases for program usage fees using killer content as a weapon results in the worst outcome, depriving small PPs of even the minimum content fees they should receive." It is said that CJ ENM is lowering overall paid broadcasting fees while raising only its own fees.

◆ "A Standard for Fee Calculation Must Be Established"

On the other hand, CJ ENM maintains a tough stance to eradicate the practice of undervaluing content and receive proper compensation. Although CJ ENM’s demand may seem excessive when simply looking at the 2.7 times increase compared to the previous year, they argue this is a ‘trap of numbers.’

CJ ENM defines the core issue of this conflict as "how to classify LG Uplus OTT as a service." Until now, CJ ENM has negotiated content usage fees linked to IPTV, but from now on, it will classify it as OTT and negotiate separately. They explain that as the OTT market has rapidly grown, they intend to realize usage fees that were previously supplied cheaply as IPTV value-added services. CJ ENM emphasized, "The practice of using content cheaply as a value-added service to increase telecom subscribers must be improved from now on."

Experts agree that such conflicts naturally arise during changes in the broadcasting market and power dynamics, but they emphasize that user damage should be minimized through active government mediation.

An industry insider pointed out, "The entire market should not be shaken by a powerful platform or a single large PP," and stressed, "We need to consider fundamental solutions to the long-standing issue of program usage fee conflicts." Specific alternatives mentioned include establishing a PP evaluation committee to eliminate poor PPs and nurture excellent PPs, and creating standards for content usage fee calculation through a win-win consultative body. Seong-sang Ahn, senior expert of the Democratic Party of Korea, suggested, "The content ‘pre-contract then supply’ bill could cause tyranny by large PPs like terrestrial broadcasters, general programming channels, and CJ, so it is necessary to consider introducing it only for small PPs with weak negotiating power."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.