Secured a 10,000㎡ Gene and Cell Therapy Production Facility, One of Europe's Largest... Scheduled for Completion in 2023

Aiming to Become a Global Supplier of Advanced Biopharmaceuticals by Combining Unmatched Technology with Mass Production Capability

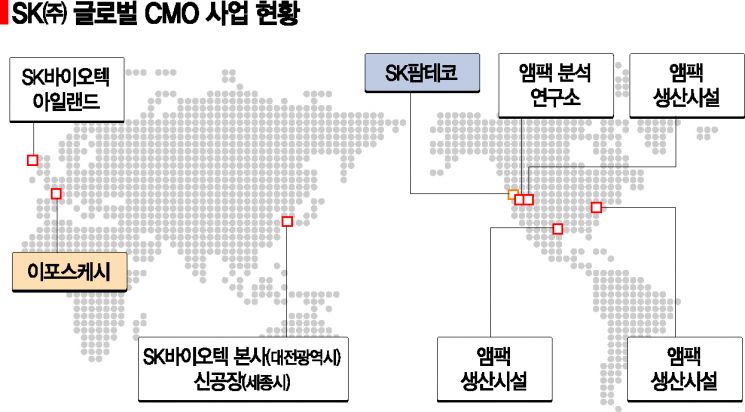

[Asia Economy Reporter Kim Hyewon] SK Inc. is stepping up its expansion after acquiring the French gene and cell therapy (GCT) contract manufacturing organization (CMO) Iposkesi in March, aiming to become the largest GCT production base in Europe.

According to SK Inc. on the 14th, Iposkesi has begun construction of a second GCT plant equipped with state-of-the-art facilities, investing approximately 58 million euros (about 80 billion KRW). Once the 5,000㎡ second plant is completed in 2023, Iposkesi will have a total GCT mass production capacity of 10,000㎡, double its current size and the largest scale in Europe. The new plant is designed to meet advanced GMP standards (cGMP, the pharmaceutical quality control standards recognized by the U.S. Food and Drug Administration (FDA)) in the U.S. and Europe, and will be located in Genopole, the French biocluster where the first plant is situated.

Exterior view of the production plant of Eposkesy, a French gene and cell therapy CMO acquired by SK Inc.

Exterior view of the production plant of Eposkesy, a French gene and cell therapy CMO acquired by SK Inc.

Iposkesi’s new production facility is expected to emerge as a global production and supply hub for GCTs targeting rare diseases with high mortality rates among biopharmaceuticals.

GCT is a personalized treatment that cures rare diseases caused by genetic defects with one or two gene injections. Despite its high cost, it shows remarkable therapeutic effects and is experiencing rapid growth. Currently, GCT accounts for about 50% of biopharmaceuticals under clinical development in the U.S., Europe, and other regions. According to Deloitte and others, it is expected to surpass antibody therapeutics, currently the largest biopharmaceutical market, through an average annual growth rate of 25% by 2025. Zolgensma, the first gene therapy for the rare disease spinal muscular atrophy, has recently received sales approval in countries including the U.S., Canada, Japan, the U.K., and Korea, reflecting a growing trend of gene therapies being approved worldwide.

The GCT field, which requires advanced technology and specialized personnel, is known to be a market difficult to enter except for a few leading global CMO companies. Iposkesi possesses core GCT research and development capabilities and a gene delivery vector (viral vector) production platform technology essential for administering therapeutic DNA into the body. With its unique technology and advanced facilities capable of mass production, it is expected to expand sales through full-scale commercialization. SK Inc. plans to maximize global management synergy by sharing SK Pharmteco’s global marketing network, mass production, and quality control capabilities with Iposkesi. SK Pharmteco is the integrated CMO subsidiary of SK Inc.

While demand for GMP-manufactured gene therapies is increasing, there are few companies with GMP facilities capable of large-scale production of gene delivery vectors, which is a positive factor strengthening Iposkesi’s global position.

Following its first plant equipped with GMP facilities, Iposkesi’s second plant has also been designed to meet GMP standards and is scheduled to begin full operation in 2023 after approvals from the European Medicines Agency (EMA) and the U.S. FDA. The second plant will be equipped with bioreactors and purification systems for mass production of gene therapies, active pharmaceutical ingredient production facilities, and quality control laboratories.

Since acquiring Bristol Myers Squibb’s (BMS) Swords plant in Ireland in 2017 and Ampac in the U.S. in 2018, SK Inc. has continued to grow in the global CMO market by establishing the integrated CMO subsidiary SK Pharmteco in California, U.S., in 2019. Through SK Pharmteco, SK Inc. acquired Iposkesi to strengthen its high-growth bio CMO portfolio and is also pursuing SK Pharmteco’s listing by 2023. SK Pharmteco recorded sales of 700 billion KRW last year, growing about sevenfold compared to 2016 before its global expansion. It aims to achieve sales of 1 trillion KRW within 2 to 3 years.

Lee Dong-hoon, head of SK Inc.’s Bio Investment Center, said, “With this expansion, Iposkesi will be equipped to actively respond to the mass production and commercialization of GCT, which is expected to grow rapidly. Iposkesi has top-level production capabilities across all stages of new drug development, from early-stage clinical trials to large-scale production after commercialization, and we anticipate various synergies with SK Pharmteco, including overseas market expansion.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)