[Asia Economy Reporter Changhwan Lee] Last year, the profits of major domestic companies significantly declined due to the impact of COVID-19. The gap in operating profit growth rates by industry also became more pronounced, indicating an intensification of polarization among companies.

According to the "Analysis of Operating Performance and Expenditure Items of the Top 100 Companies by Sales in 2020" released by the Korea Employers Federation on the 13th, the total sales of the top 100 domestic companies by sales last year amounted to 984.1 trillion KRW, a 6.7% decrease compared to 1,054.8 trillion KRW in 2019.

During the same period, their total operating profit was 47.2 trillion KRW, down 2.5% from the previous year.

Among them, the total operating profit of 99 companies excluding Samsung Electronics in 2020 was 26.7 trillion KRW, a sharp decline of 22.2% compared to 34.3 trillion KRW in the previous year. The Korea Employers Federation explained that a considerable number of companies suffered hits to both sales and operating profits due to COVID-19.

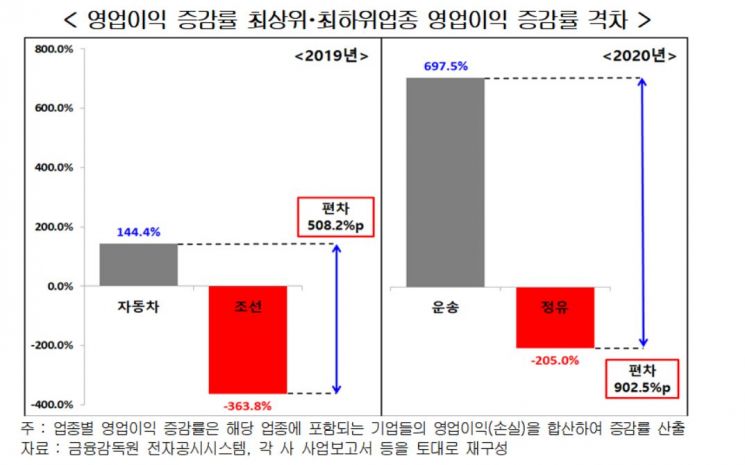

The gap in operating profit growth rates by industry also widened. The difference in operating profit growth rates between the transportation industry, which saw the largest increase at 697.5%, and the petroleum industry, which experienced the largest decrease at -205.0%, was 902.5 percentage points, expanding from the 508.2 percentage points gap between the top and bottom industries in 2019.

In the case of the transportation industry, from the second half of last year, global container cargo volume increased, causing sea freight rates to rise, which led to a surge in HMM's operating profit. Korean Air and Asiana Airlines also improved their operating profits compared to 2019 by shifting their revenue structure to focus on cargo transportation despite a decrease in passenger demand.

Although profits decreased, expenditures increased. The total employee salaries of the top 100 companies last year amounted to 78.4 trillion KRW, a 3.0% increase compared to 2019, and research and development expenses were 38.1 trillion KRW, up 4.0% from 2019.

Ha Sangwoo, Head of the Economic Research Department, stated, “The operating profits of the top 100 companies by sales in 2020 showed somewhat weaker performance compared to 2019, which had already deteriorated significantly from 2018, and especially the performance gap between industries became more distinct. While differences in performance due to industry-specific economic cycles and changes in market environments are inevitable, if the business conditions of poorly performing industries do not improve over a long period, various problems may arise.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)