Ijuyeol, Governor of the Bank of Korea

Commemorative Speech for the 71st Anniversary of the Bank of Korea Establishment

"Orderly Normalization of Monetary Policy, Key Focus for the Second Half of the Year"

Mention of Side Effects of Prolonged Low Interest Rates... "Worsening Asset Inequality"

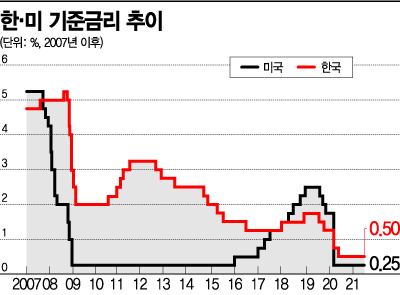

[Asia Economy Reporter Kim Eun-byeol] The end of the ‘ultra-low interest rate era’ that has lasted for over a decade since the 2008 global financial crisis is approaching. With the rapid recovery of the global economy, soaring inflation, and debt growing to an unmanageable level due to massive monetary easing, interest rate hikes within this year are becoming a foregone conclusion. It is being assessed that the era of deflation is ending and we are entering an era of inflation.

The Bank of Korea (BOK) has recently been signaling interest rate hikes ‘more frequently’ and ‘more strongly.’ On the 11th, BOK Governor Lee Ju-yeol cited ‘orderly normalization of monetary policy’ as a key task to be pursued in the second half of the year during the ‘71st Anniversary Speech of the Bank of Korea.’ Compared to his statement after the Monetary Policy Committee meeting at the end of last month, where he mentioned "maintaining an accommodative stance for the time being," this clearly shows a hawkish (preference for monetary tightening) stance. Within the BOK, this was interpreted as emphasizing the necessity of raising the base interest rate within the year.

What is particularly noteworthy in this anniversary speech is that Governor Lee addressed the side effects of ultra-low interest rates, which had been relatively avoided until now. He stated, "Bold economic stimulus measures unprecedentedly implemented by governments and central banks worldwide greatly helped overcome the crisis, but it is also true that imbalances between sectors and social classes have widened in the process."

He added, "The risk-taking appetite of economic agents has increased, causing asset prices to rise rapidly compared to the real economy, resulting in worsening asset inequality," and "The scale of private debt has greatly expanded, and recently concerns about global inflation have also increased." The BOK’s forecast for this year’s annual inflation rate is 1.8%, expected to approach the price stability target of 2.0%.

On the morning of May 27, Lee Ju-yeol, Governor of the Bank of Korea, presided over the Monetary Policy Committee plenary meeting at the Bank of Korea in Jung-gu, Seoul, tapping the gavel.

On the morning of May 27, Lee Ju-yeol, Governor of the Bank of Korea, presided over the Monetary Policy Committee plenary meeting at the Bank of Korea in Jung-gu, Seoul, tapping the gavel. [Photo by Yonhap News]

Professor Lee In-ho of Seoul National University’s Department of Economics recently commented on capital flows, saying, "Both corporations and households have experienced worsening imbalances through the COVID-19 pandemic," and "What central banks can do is to prevent further bubbles in the asset market through monetary policy." He evaluated that the BOK’s interest rate hike is inevitable given the financial stability situation. Analyst Gong Dong-rak of Daishin Securities interpreted Governor Lee’s strong indication of preference for tightening by saying, "The hawk has come back (Hawk, come back)." In particular, he interpreted the remarks as "placing more weight on financial stability than price stability."

As the low inflation era ends, pressure for interest rate hikes is also increasing in the United States. The U.S. Department of Labor announced on the 10th (local time) that the Consumer Price Index (CPI) for May rose 5.0% year-on-year, exceeding the expected 4.7%. The core CPI inflation rate also recorded 3.8%, the highest since 1992. This is interpreted as a signal that the Federal Reserve’s tightening possibility has increased.

Deutsche Bank recently stated in a report, "Since President Donald Reagan and Fed Chairman Paul Volcker fought inflation 40 years ago, we are now at an important turning point in global macroeconomic policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.