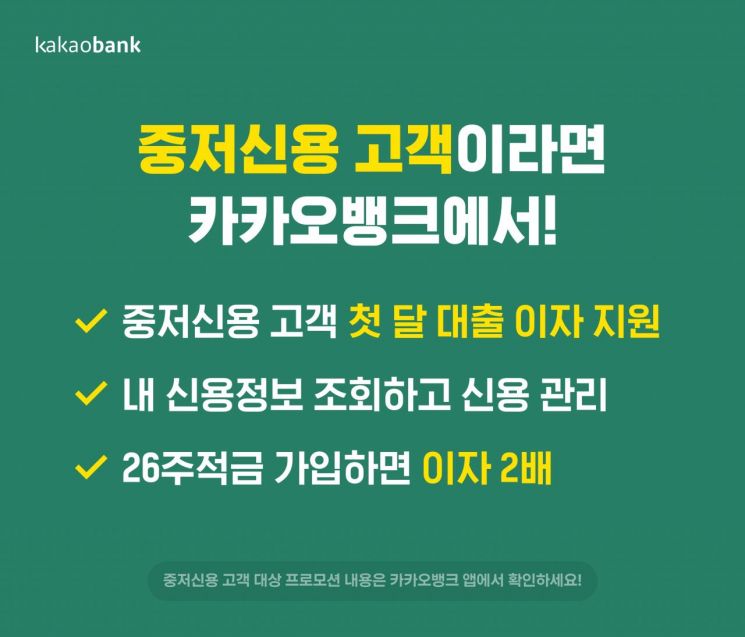

[Asia Economy Reporter Kiho Sung] KakaoBank announced on the 11th that it will provide various supports such as loan interest for middle- and low-credit customers with a credit score of 820 or below.

First, starting from the 10th, middle- and low-credit customers who newly take out a credit loan or a salaried worker Sa-it-dol loan at KakaoBank will receive support for the first month's interest. The target customers are those with a Korea Credit Bureau (KCB) credit score of 820 or below. No separate application is required, and the first month's interest will be paid to the customer's KakaoBank account under their name. The first-month interest exemption benefit applies only to customers who execute a new loan by the 9th of next month.

KakaoBank applied a new credit evaluation model from the 9th and expanded the maximum limit of the 'middle-credit loan product' to 100 million KRW. In addition, the additional interest rate for the 'middle-credit loan' was lowered by up to 1.52 percentage points, making the lowest interest rate 2.98% as of the 11th.

For middle- and low-credit customers, a promotion doubling the interest on the 26-week installment savings regardless of loan status also started on the 10th. Customers with a KCB credit score of 820 or below can receive the benefit by subscribing to the 26-week installment savings. Upon maturity of the 26-week installment savings, customers will receive a cashback equivalent to the interest into their KakaoBank account under their name. This applies to customers who subscribe to the 26-week installment savings by the 9th of next month, and only one new account per customer is allowed.

A KakaoBank official said, “We have been considering and preparing ways to provide benefits not only in loans but also in deposit products for middle- and low-credit customers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.