Financial Services Commission Announces May Household Loan Trends

Mortgage Loan Growth Slightly Reduced... Credit Loan Records Largest Monthly Decrease Ever

Monthly Household Loan Balance Declines for First Time in 7 Years and 4 Months

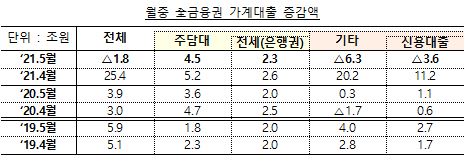

[Asia Economy Reporter Jin-ho Kim] The increase in household debt has stopped for the first time in 7 years and 4 months. Last month, household loans across all financial sectors decreased by 1.8 trillion KRW, breaking the upward trend.

This is attributed to the large-scale repayment of credit loans following the refund of subscription deposits from the SK IE Technology (SKIET) IPO, which attracted the largest-ever subscription deposits. However, excluding temporary factors, the market believes it is difficult to see the household loan growth trend as having been broken.

According to the "May Household Loan Trends" announced by the Financial Services Commission on the 10th, household loans across all financial sectors decreased by 1.8 trillion KRW last month. Considering that the increase in April was 25.4 trillion KRW, this is a noticeable decline. It is the first time in 7 years and 4 months since January 2014 (-2.2 trillion KRW) that the monthly household loan balance has decreased.

Both mortgage loans and credit loans, including other loans, decreased sharply compared to the previous month. As of the end of May, the year-on-year growth rate of household loans across all financial sectors also fell to 9.6% from 10% in the previous month.

In the case of mortgage loans, they increased by 4.5 trillion KRW last month, narrowing from 5.2 trillion KRW in the previous month. The main cause is the decline in housing transaction volume. Last month, nationwide housing sales transactions were 93,000 units, down from 102,000 units in the previous month.

The increase in mortgage loans by banks grew from 4 trillion KRW in July last year to 6.1 trillion KRW in August, 6.7 trillion KRW in September, and 6.8 trillion KRW in October. The increase narrowed to 6.2 trillion KRW in November but rose again to 6.3 trillion KRW in December, and since then, it has consistently shown an increase of over 4 trillion KRW per month this year.

In the case of credit loans, the refund of SKIET IPO subscription deposits in early May led to a decrease of 5.3 trillion KRW, driving the reduction in household loans. The decrease in other loans, mostly credit loans (with a balance of 276 trillion KRW), was the largest since related statistics began in 2004.

By sector, household loans in the banking sector decreased by 1.5 trillion KRW. The secondary financial sector also saw a decrease of 300 billion KRW. Both are due to the narrowing increase in mortgage loans and the repayment of credit loans following the refund of SKIET subscription deposits.

Some express concerns that the household loan growth may accelerate again this month as a temporary situation. Next month, the Total Debt Service Ratio (DSR) regulation will apply to individual borrowers, leading to expectations that loan demand may surge this month.

A Financial Services Commission official explained, "Loans that temporarily surged due to IPO subscriptions decreased in May due to subscription deposit refunds," adding, "We will continue to closely monitor household loan trends and prepare thoroughly to ensure that the 'Household Debt Management Plan' is implemented consistently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.