[Asia Economy Reporter Jeong Hyunjin] South Korea's private debt has increased 1.6 times faster than the major five countries (G5) over the past five years. This means that during the same period, the increase in private debt in South Korea was greater than that of the G5, and household debt grew faster than income, indicating a further deterioration in South Korea's debt repayment capacity.

On the 10th, the Korea Economic Research Institute under the Federation of Korean Industries announced this analysis by utilizing statistics from the Bank for International Settlements (BIS), the Organisation for Economic Co-operation and Development (OECD), and others. They analyzed the trends of household and corporate private debt in South Korea, 43 countries surveyed by BIS worldwide, and the G5 (United States, Japan, United Kingdom, France, Germany) over the recent five years from the end of 2016 to the end of last year.

According to the analysis, South Korea's household debt-to-GDP ratio increased from 87.3% to 103.8%, rising by 16.5 percentage points in just five years. The average increase in the household debt-to-GDP ratio among the 43 countries was 11.2 percentage points during the same period, and the G5 saw an increase of 6.4 percentage points. Corporate debt in South Korea also rose from 94.4% of GDP at the end of 2016 to 111.1% at the end of last year, an increase of 16.7 percentage points. During the same period, the average among the 43 countries increased by 18.0 percentage points, and the G5 by 14.9 percentage points.

South Korea's household debt relative to GDP reached its highest level since statistics began in 1962, and corporate debt also reached its highest level since the foreign exchange crisis. The increase in household debt was 2.6 times that of the G5, and corporate debt also exceeded the G5's increase. Choo Kwang-ho, Director of Economic Policy at the Korea Economic Research Institute, analyzed, "The increase in South Korea's private debt over the recent five years was 33.2 percentage points, which is steeper than the 21.8 percentage points increase in the five years before the U.S. financial crisis."

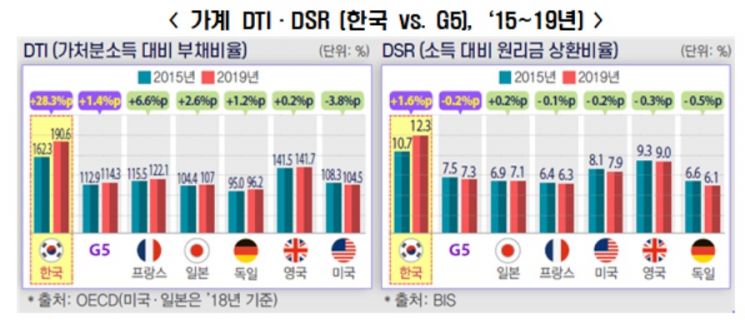

The Korea Economic Research Institute pointed out that South Korea's debt repayment capacity is rapidly deteriorating. When comparing DTI (debt-to-disposable income ratio) and DSR (debt service ratio), which are representative indicators evaluating debt levels through income, with those of the G5, South Korea's household debt is increasing faster than household income, rapidly weakening repayment capacity. Compared to 2015, South Korea's household DTI increased by 28.3 percentage points by 2019, which is 20 times the G5 increase of 1.4 percentage points. Household DSR also increased by an average of 1.6 percentage points in South Korea during the same period, while the G5 saw a decrease of 0.2 percentage points.

For corporations, as of the end of last year, South Korea's DSR ratio was 39.7%, lower than the G5's 42.7%. The increase in DSR over the recent five years was 3.7 percentage points in South Korea and 6.6 percentage points in the G5, indicating that South Korean companies' debt repayment capacity is relatively sound.

The Korea Economic Research Institute emphasized, "Since South Korea's private sector has weak interest rate defense capabilities, it is necessary to avoid preemptive tightening monetary policies compared to the United States." This is interpreted as a caution considering that the possibility of an early base interest rate hike by the Bank of Korea is being raised, and that rising interest rates could lead to interest burdens that might destabilize household and corporate debt.

The Korea Economic Research Institute explained, "Households have asset portfolios concentrated in real estate, making them vulnerable to liquidity crises, and many households are running deficits, so low-income groups may face difficulties when interest rates rise." They added, "The proportion of marginal companies that have not covered interest expenses with operating profits for three consecutive years is high, so interest rate hikes could severely impact small businesses." They further emphasized, "Rather than artificial debt reduction, the fundamental solution to reducing private debt is to enhance corporate competitiveness to increase profit generation and debt repayment capacity, and to expand the capacity for employment and wage payments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.