Financial Services Commission Reviews Final Approval Today

Mid-Interest Rate Loan Market Battle Expected

[Asia Economy Reporter Kiho Sung] With the confirmed launch of ‘Toss Bank’ in the second half of this year, the era of the internet-only bank trinity is entering its final countdown. Despite being a latecomer, big tech companies are regarded as ‘catalysts’ shaking up the financial market by leveraging their existing platform customer base and brand recognition. In particular, Toss has announced that, unlike KakaoBank and K Bank, it will focus on targeting middle- and low-credit borrowers, causing not only commercial banks and existing internet banks but also savings banks with overlapping target demographics to become highly alert.

According to the financial sector on the 9th, the Financial Services Commission will review the main license for Toss Bank’s internet-only banking business, Kakao Pay’s preliminary license for a digital non-life insurance company, and the approval of peer-to-peer (P2P) financial transaction permits at its scheduled regular meeting in the afternoon.

Viva Republica, which operates the Toss service, challenged the internet-only banking sector and received a preliminary license from the Financial Services Commission in December 2019. Subsequently, it formed the Toss Innovation Preparation Corporation, prepared for corporate establishment, and applied for the main license for internet-only banking on February 5. Financial authorities and the market expect that Toss Bank’s main license will be approved without difficulty on this day.

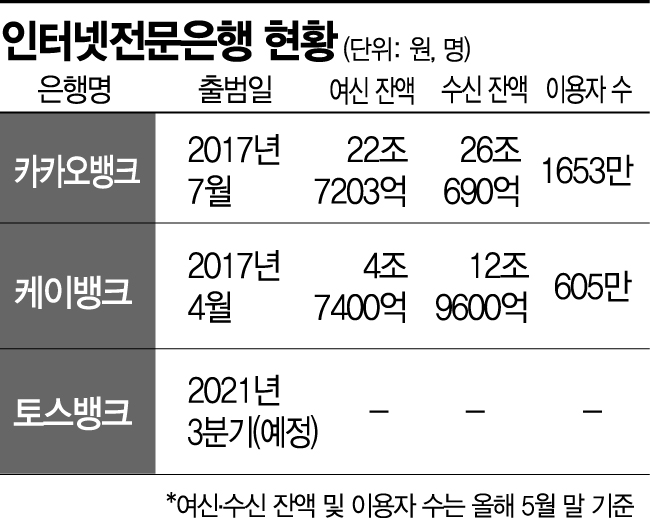

If Toss Bank’s official service begins as early as September, the number of internet-only banks will increase to three, following KakaoBank and K Bank.

The financial sector’s attention to Toss Bank is due to the ‘catalyst effect’ brought by the third internet-only bank (where the emergence of a strong competitor boosts the competitiveness of existing competitors). The arrival of Toss Bank inevitably changes the existing competitive structure that had been divided between KakaoBank and K Bank. Savings banks, whose target customer base overlaps, are also closely monitoring Toss’s moves.

The biggest change is expected in the mid-interest loan sector. Currently, financial authorities are encouraging internet-only banks to expand mid-interest loans. Last month, the Financial Services Commission announced a plan to expand mid-interest loans, requiring internet-only banks to allocate more than 30% of their credit loans to borrowers with credit ratings below grade 4 by the end of 2023.

Through its business plan submitted to financial authorities, Toss Bank reported that it will set the proportion of mid-interest loans to 34.9% of total loans by the end of this year after its launch. By the end of 2023, it pledged to raise the proportion of mid-interest loans to 44%, about half of total loans. This surpasses the plans of KakaoBank and K Bank, which aim to expand to 30% by 2023.

Industry insiders view Toss’s aggressive mid-interest loan expansion as not only aligning with the financial authorities’ policy direction but also presenting a ‘differentiation strategy’ distinct from existing internet banks.

As the launch of Toss Bank approaches, the mid-interest loan market is already becoming a battleground. KakaoBank announced an expansion plan for mid-credit loans earlier and revealed on this day that it applied a new credit scoring system (CSS) and increased the maximum limit of mid-credit loan products to 100 million KRW. K Bank is also responding with CSS advancement and a record-sized paid-in capital increase of 1.25 trillion KRW last month.

An industry official said, “The launch of the third internet-only bank will broaden choices for customers and intensify service competition within the industry. Especially, mid-interest loans are likely to enter interest rate competition, and future success will depend on screening and risk management.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.