Net Selling of 507.9 Billion KRW on KOSPI This Month

Poor Returns on Holdings Like Samsung Electronics and Hyundai Mobis

Contrasting Foreign and Institutional Net Buying Trends

June 'Gopbus' ETF Purchased for 211.1 Billion KRW

[Asia Economy Reporters Song Hwajeong and Lee Minwoo] It has been revealed that the investment sentiment of individual investors, who have been driving the stock market rally, is weakening. Although they have continued their buying momentum this year to defend against index declines, their buying power has recently weakened sharply. In this weakened sentiment environment, individuals are purchasing ‘Gopbus’ products, adding weight to the index decline.

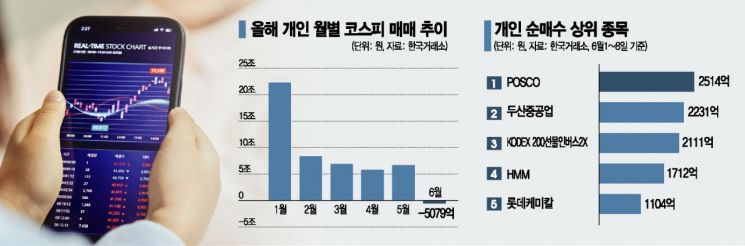

According to the Korea Exchange on the 9th, individual investors have net sold 507.9 billion KRW in the KOSPI market so far this month until the previous day. This contrasts with foreigners and institutions, who have net bought 7 billion KRW and 535.6 billion KRW respectively during the same period. If this trend continues, it is possible that individuals will turn to net selling on a monthly basis for the first time this month. After recording an unprecedented net buying of 22.3384 trillion KRW in January, individuals have maintained a buying stance with net purchases of 8.4381 trillion KRW in February, 6.9402 trillion KRW in March, 5.8355 trillion KRW in April, and 6.7296 trillion KRW in May.

In particular, individuals became even more aggressive buyers after the KOSPI reached an all-time high this year, but this pattern is not appearing this time. The KOSPI closed at 3,252.12 on the 7th, setting a new all-time high. The next day, individuals net sold 44.7 billion KRW. Previously, after the KOSPI first surpassed the 3,200 mark on January 25, individuals net bought 4.205 trillion KRW the following day, showing four consecutive days of trillion-KRW net buying. Similarly, after reaching 3,220 on April 22 and setting a new record high, individuals bought 2.7115 trillion KRW the next day, continuing net buying for three days. After breaking the all-time high again on the 10th of last month, individuals recorded five consecutive days of net buying, with three of those days seeing trillion-KRW purchases, totaling 9.116 trillion KRW over five days.

The poor returns on stocks purchased by individuals appear to be the cause of the weakened investment sentiment. So far this year, individuals have net bought Samsung Electronics the most, with 21.9229 trillion KRW, but Samsung Electronics is down 1.33% compared to the beginning of the year. Especially, it has fallen 15.39% from the all-time intraday high of 96,800 KRW recorded on January 11. Individuals have sold the most Samsung Electronics this month. The Samsung Electronics preferred shares, which rank second in net purchases, are down 14.52% from the January peak, and Hyundai Mobis, ranked third in net purchases, has fallen 28.89% from the January high.

Instead, individual investors are heavily buying ‘Gopbus (Gop + Inverse)’ products, which profit when the index falls. This seems to reflect their judgment that the stock market will struggle amid concerns over the U.S. Federal Reserve’s tapering (reduction in asset purchases) and the upcoming May consumer price index announcement.

According to the Korea Exchange, individual investors have net bought 211.1 billion KRW worth of the inverse exchange-traded fund (ETF) called ‘KODEX200 Futures Inverse 2X’, commonly known as Gopbus, so far this month until the previous day. This ranks third in individual net purchases during the period, following steel ‘leader’ POSCO (251.4 billion KRW) and Doosan Heavy Industries (223.1 billion KRW). On the 3rd, when the KOSPI broke through the 3,250 mark intraday for the first time in about a month, individuals net bought 178.1 billion KRW in a single day, setting the largest daily net purchase record this year. Additionally, the ‘KODEX Inverse’, which tracks the KOSPI index decline, was also purchased at around 45 billion KRW (ranked 19th in individual net purchases).

Although the KOSPI continues its high-level rally, individuals are judging that the upside is limited and are responding quickly in anticipation of an index decline. The KOSPI formed a short-term bottom at 3,122.11 (closing price) on the 13th of last month and has steadily risen since. On the 7th, it recorded a closing all-time high of 3,252.12. This represents an increase of about 4.2% in about a month. During the previous day’s session, it reached 3,264.67, climbing to the 3,260 level. This is just below the all-time intraday high of 3,266.23 recorded on January 11.

Choi Yujun, a researcher at Shinhan Financial Investment, explained, “With the KOSPI’s upside limited and sector rotation continuing, individuals are responding with short-term trading. As tapering discussions grow louder, they are cautious about macroeconomic data releases such as the U.S. Consumer Price Index (CPI) announcement in May.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)