Server and Mobile DRAM Focus

Industry: "Too Early to Predict Trend Decline... Will Rise Again"

[Asia Economy Reporter Suyeon Woo] Since April, DRAM prices, which had entered a pause phase, are gaining momentum to return to an upward trend from the second half of the year. Industry experts argue that after adjustments to the burden of sharply increased prices, DRAM prices, especially for server and mobile use, will rise again starting in the second half.

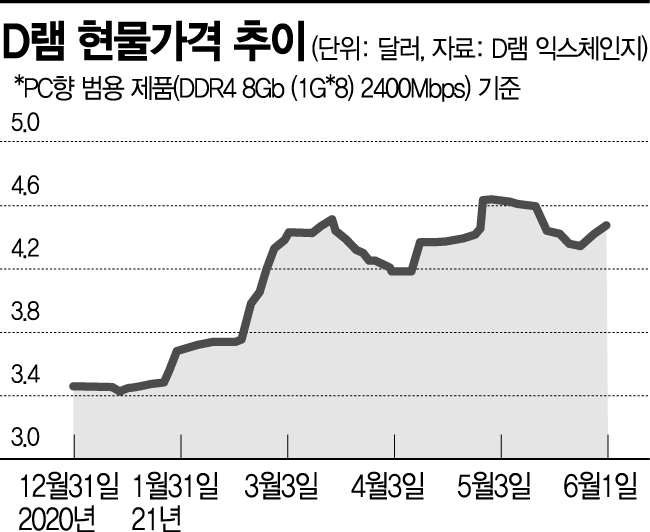

According to DRAMeXchange on the 7th, the spot price of DRAM (PC general-purpose DDR 8Gb) stood at $4.475. The DRAM spot price surged more than 30% in about four months from around $3.4 at the beginning of this year to $4.658 at the end of April. Since May, the upward momentum has slowed, fluctuating around $4.3, while fixed transaction prices (DDR4 8Gb) rose sharply by 26% in April to $3.8 and then remained flat in May.

This was largely due to a temporary slowdown in server DRAM demand, which was expected to be robust. Recently, North American hyperscaler companies operating large-scale data centers have extended their inventory periods to 8?10 weeks, responding to the sharply increased server DRAM prices in a short period.

Despite this situation, the industry is focusing on the fact that hyperscalers’ server DRAM inventory levels are still lower than previous peak levels, placing weight on the price increase trend in the second half. It is also expected that server investments will concentrate on new data center construction by these companies from the second half of this year through 2023, supporting this outlook.

Recently, the mobile DRAM market has shown signs of slowing growth due to production disruptions caused by non-memory semiconductor shortages and decreased smartphone demand in the Indian market due to the resurgence of COVID-19. Some suggest that Samsung’s smartphone sales forecast for this year may be revised downward from 270 million units to around 260 million units due to the sluggish Indian market.

However, the industry expects that the mobile DRAM market will remain tight, and prices will not fall in the third quarter. According to securities firms such as Samsung Securities, it is reported that major U.S. customers and suppliers recently signed third-quarter mobile DRAM contracts with a 20?25% increase compared to the previous quarter.

Choi Doyeon, a researcher at Shinhan Financial Investment, forecasted, "From the end of the second quarter, as the non-memory supply shortage eases and server demand joins mobile, DRAM spot prices will soon enter a re-ascending phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.