Possibility of New KOSPI Highs... Rotation Market

Focus on Semiconductors and Consumer Goods... US CPI as a Variable

[Asia Economy Reporter Lee Seon-ae] The KOSPI index is raising expectations for a new all-time high. Accelerated domestic vaccination and strong exports are creating a favorable environment for the domestic stock market. Although concerns about inflation remain, market expectations for economic recovery have significantly increased. However, there are also voices cautioning about volatility, as indicators such as the US Consumer Price Index (CPI) could trigger tapering (reduction of asset purchases) if they deviate from expectations.

According to the Korea Exchange on the 7th, the KOSPI opened at 3,244.59, up 4.51 points (0.14%) from the previous trading day. This week could see the KOSPI reach a new record high. The KOSPI closed at 3,240.08 on the 4th, postponing the record update to this week. This is only 9.22 points away from the all-time high of 3,249.30 recorded on the closing price basis on the 10th of last month.

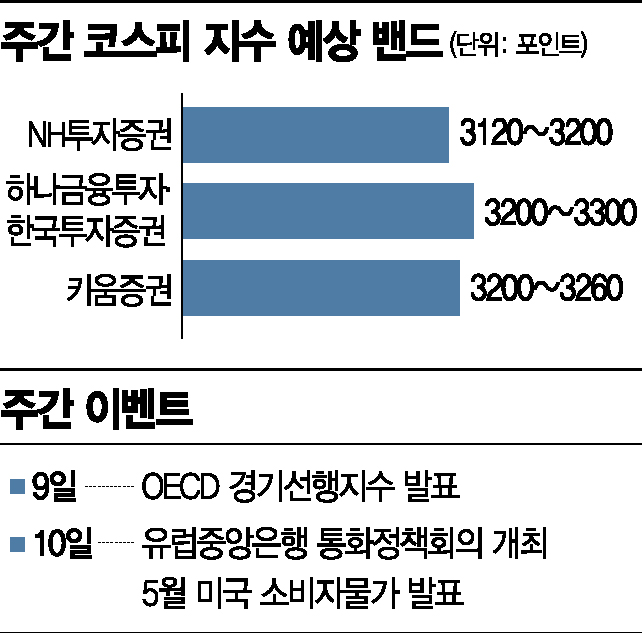

The upper band of the expected KOSPI index range for this week, as forecasted by securities firms, is 3,300. Kiwoom Securities suggested an upper limit of 3,260. Han Ji-young, a researcher at Kiwoom Securities, predicted, "The Korean stock market is expected to attempt a new all-time high this week, driven by relief from US employment data and expectations for accelerated economic normalization due to the expansion of vaccination speed." However, she pointed out variables such as the US CPI in May (on the 10th), the European Central Bank (ECB) monetary policy meeting in June (on the 10th), and the domestic futures and options simultaneous expiration date (on the 10th). She explained, "Cautious sentiment surrounding these major midweek events is expected to limit the upper range of the index."

Hana Financial Investment and Korea Investment & Securities, which also set the KOSPI upper limit at 3,300, identified the US CPI as a key variable. Lee Jae-sun, a stock market researcher at Hana Financial Investment, analyzed, "The domestic stock market is expected to show a neutral trend ahead of the US inflation data release, but if the US CPI exceeds market expectations, market volatility could increase in the short term." However, he added, "If the CPI does not deviate significantly from expectations, the intensity of market corrections is expected to be lower than last month," emphasizing, "Above all, the rising vaccination rate is clearly a positive factor for the stock market."

Among the 27 KOSPI sectors, 20 sectors have outperformed the market return, continuing an active rotation market. Securities firms are raising their voices to focus on sectors that have risen less. Seo Jeong-hoon, a researcher at Samsung Securities, said, "Since domestic export momentum and the resulting upward revision of earnings estimates can continue, it is still necessary to maintain interest in cyclical stocks focused on intermediate goods exports," citing steel & metals, chemicals, machinery, shipbuilding, and construction as targets. He added, "In the process of recovering the 3,200 level, catch-up rallies are possible for relatively neglected sectors such as automobiles, semiconductors, and secondary batteries."

Lee Jae-man, a researcher at Hana Financial Investment, said, "Sectors that can increase operating profits consecutively in the second and third quarters this year include semiconductors, software, chemicals, transportation, construction, essential consumer goods, and media. Among these, semiconductors, chemicals, and essential consumer goods have lower average returns." He emphasized, "In particular, the semiconductor sector's market capitalization share in the KOSPI has dropped to 27%, the level of the third quarter low last year, while its operating profit share is expected to rise from 18% in the first quarter to 26% in the second quarter and 31% in the third quarter, indicating that it is time to increase its weighting."

Park Seok-hyun, an investment strategy researcher at KTB Investment & Securities, said, "The domestic COVID-19 vaccination rate for at least one dose has exceeded 12%, which will act as a catalyst to strengthen the recovery of the consumption economy," advising, "Attention should be paid to consumer goods sectors such as automobiles, retail (distribution), and media, which can benefit from economic normalization and consumption recovery." Kim Seong-geun, a researcher at Korea Investment & Securities, also expressed expectations, saying, "Although inflation remains a key market theme, as domestic vaccination accelerates, the relative strength of consumer discretionary goods is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.