Hankyung Research Institute Analyzes Economic Impact and Implications of US Interest Rate Hikes

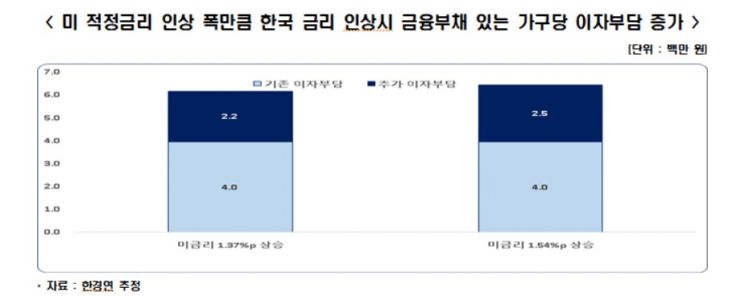

[Asia Economy Reporter Kim Heung-soon] An analysis has revealed that if South Korea's short-term government bond yields rise by the same appropriate rate hike magnitude as the United States, the annual interest burden per household with financial debt could increase by up to 2.5 million KRW. It is pointed out that if Korea does not raise rates in tandem, foreign investment inflows will decrease, and if rates are raised, the interest burden on household debt will increase, placing the country in a difficult situation that requires thorough preparation of countermeasures.

The Korea Economic Research Institute (KERI) under the Federation of Korean Industries announced this on the 7th through its analysis titled "Possibility of US Rate Hikes and the Economic Impact and Implications of Rate Increases."

Reflecting US Inflation and Economic Conditions

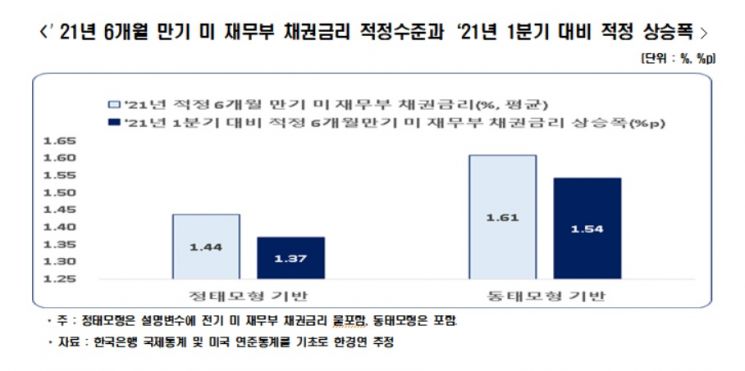

Estimated Appropriate Rate Increase Range: 1.37 to 1.54 Percentage Points

The year-on-year consumer price inflation rate in the US for April this year was 4.2%, marking the highest level in 13 years since 5.0% in September 2008. The International Monetary Fund (IMF) revised its growth forecast in April to 6.4% for this year, increasing the likelihood that the timing of US rate hikes will be accelerated.

By establishing a model explaining the US short-term government bond yield (6-month Treasury bond yield) using economic variables such as the US inflation rate (year-on-year consumer price inflation), unemployment rate, and money supply, and applying the Federal Reserve's forecasts for these variables this year, the estimated appropriate short-term bond yield was analyzed. The appropriate yield for the 6-month US Treasury bond is expected to rise by 1.37 to 1.54 percentage points compared to the 0.07% level in Q1 2021. KERI predicted, "If the US Federal Reserve begins to raise the benchmark interest rate, it will continue to raise rates until the short-term government bond yield reaches an appropriate level."

US Appropriate Rate Increase Could Reduce Foreign Investment Inflows to Korea by $1.6 to $1.8 Billion

Annual Household Loan Interest Could Increase by 25.6 to 28.8 Trillion KRW with Equivalent US Rate Hike

KERI estimated the impact of US rate hikes by establishing a model explaining the net inflow ratio of foreign investment funds relative to GDP using the interest rate differential between the US and Korea (US rate minus Korean rate) and the expected fluctuation rate of the KRW-USD exchange rate. According to this, if the US raises its benchmark rate causing the 6-month bond yield to increase by 1.37 to 1.54 percentage points compared to Q1 2021, the net outflow of foreign investment funds from the Korean market is expected to reach $1.6 to $1.8 billion.

KERI also estimated a model explaining South Korea's household loan interest rates by Korean short-term government bond yields and calculated the increase in household loan interest burden if Korea's short-term government bond yields rise by the same magnitude as the US appropriate rate hike. The average household loan interest rate is expected to increase by 1.54 to 1.73 percentage points. The annual increase in household loan interest burden due to the rate hike is estimated at 25.6 to 28.8 trillion KRW. Applying the proportion of households with financial debt (57.7% in 2020, Statistics Korea Household Finance and Welfare Survey) and the total number of households (20.1 million in 2019, Statistics Korea estimate), the annual interest burden per household with financial debt is estimated to increase by 2.2 to 2.5 million KRW.

Proactive Price Stability and Smooth Household Debt Adjustment

Need to Prevent Capital Outflows through Fiscal Stability

KERI argued that if the US raises rates, South Korea could face a difficult situation and must focus all efforts on preparing response strategies. Raising rates following the US raises concerns about the massive household loan problem, while freezing rates raises worries about capital outflows.

Choo Kwang-ho, Director of Economic Policy at KERI, stated, "Considering excessive private debt, proactive rate hikes ahead of the US are not desirable," and added, "It is urgent to focus on fiscal efficiency and securing national debt soundness while enhancing corporate competitiveness and expanding employment to strengthen the private sector's resilience against rate hikes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.