[Asia Economy Reporter Minji Lee] Crocs is expected to show additional growth driven by reopening optimism after COVID-19 and its popularity among the MZ generation (those born from the early 1980s to the early 2000s).

On the 6th, Shinhan Financial Investment projected Crocs' expected sales and operating profit for this year at $2.04 billion and $480 million, respectively, forecasting increases of 47% and 125% compared to the previous year. This outlook is based on the belief that high growth will continue despite the base effect from the COVID-19 windfall. Crocs is a footwear brand that has grown based on its unique style and convenience. It manufactures all its shoes using a specially developed proprietary material. Its flagship product, the 'Clog,' is loved as a leisure shoe for being comfortable, lightweight, and resistant to odor and slipping.

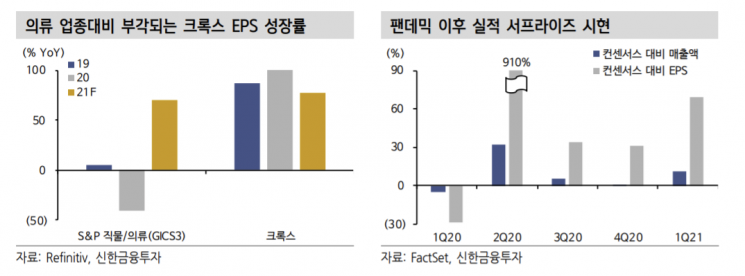

Thanks to the COVID-19 pandemic windfall, Crocs grew by about 100% last year. This contrasts with the S&P apparel sector, which saw a correction of about 40%, influenced by consumers increasingly preferring comfortable attire amid restricted outdoor activities.

With the full-scale supply of vaccines and pent-up consumption from COVID-19 increasing, Crocs' performance is expected to grow further. The reopening optimism has risen, and recently the company raised its guidance for this year. The expected sales for this year were revised upward by 17-20% to $1.94?2.08 billion compared to previous forecasts. Since the second and third quarters are seasonal peak periods that coincide with the reopening phase, performance is expected to improve further.

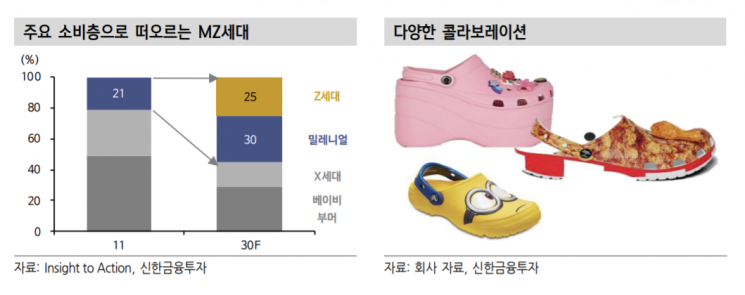

The expanded penetration within the MZ generation is also positive. The MZ generation pursues practicality and comfort but also values self-expression. Hyunji Lee, a researcher at Shinhan Financial Investment, said, “As the original ugly shoes, Crocs are rough but comfortable to wear, and with customizable 'Jibbitz' (items to decorate Crocs), they are attracting the attention of young consumers,” adding, “They are increasing exposure on digital channels to expand the new consumer base.” Crocs' digital channel penetration grew from 11% in 2015 to 42% last year.

As of last year, the sales distribution by region was 62% in the U.S., 20% in Asia, and 18% in EMEA. The U.S. share is expanding, and the core markets driving growth are the U.S., Japan, China, Korea, and Germany. In particular, expectations for expansion into the Asian market are high. Although Asia's sales share grew to 40.7% in 2012, it shrank to 20.1% last year, but growth centered on China is expected to continue. The researcher explained, “Crocs is focusing on celebrity marketing and online platforms in the Chinese market,” adding, “If market share expands in the high-consumption Asian market, valuation rerating could also occur.”

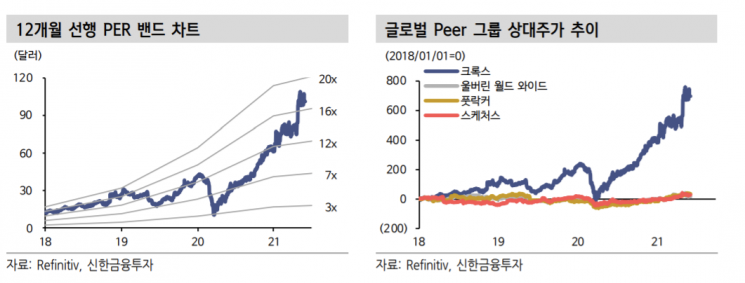

The researcher added, “Last year, the company's competitiveness stood out amid crisis situations, and its stock price rose more than tenfold from the March low, but the price burden is not considered high,” noting, “Compared to the global competitors' average price-to-earnings ratio (PER) of 22.5 times excluding Nike, Crocs' valuation at 16.6 times is attractive.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.