[Asia Economy Reporter Minji Lee] Despite the increase in the reserve requirement ratio by Chinese authorities, the yuan's strong trend is expected to remain unbroken.

On the 6th, KTB Investment & Securities predicted that the yuan exchange rate in the second half of the year will fluctuate around 6.4 yuan. The average yuan exchange rate for the second half is expected to be 6.41 yuan, and the annual average rate is forecasted at 6.44 yuan, appreciating about 7% compared to last year. Although Chinese authorities raised the foreign currency reserve requirement ratio to curb yuan depreciation, this measure is seen only as a brake on the steep yuan appreciation and cannot change the overall direction.

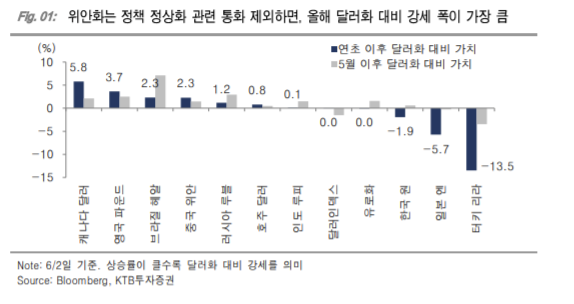

On the 31st of last month, the People's Bank of China raised the foreign currency reserve requirement ratio for financial institutions for the first time since 2007. It was increased from 5% to 7%, effective from the 15th of this month. The yuan's value against the dollar has risen by 2.3% since the beginning of the year. Except for countries normalizing monetary policy, this is the largest appreciation. As the yuan exchange rate fell to around 6.35 yuan, foreign exchange authorities took active measures.

KTB Investment & Securities predicted that despite the increase in the reserve requirement ratio, the yuan's strong trend will not be broken. Above all, they judged that the authorities have little incentive to induce yuan depreciation from an export perspective. China's export ratio to GDP has been continuously declining since 2010, and the share of processing exports, where price competition is relatively important, has also decreased. Therefore, there is no need to artificially induce yuan depreciation to create favorable conditions for exports.

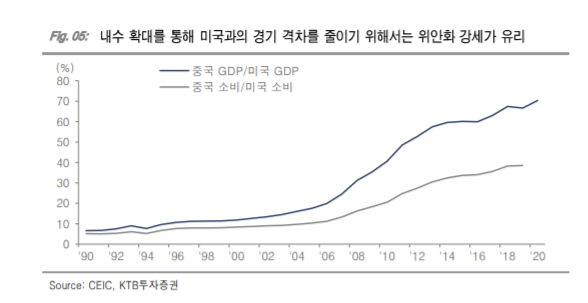

Furthermore, to secure medium- to long-term growth engines such as strengthening domestic demand, a sustained environment of yuan appreciation is advantageous. Im Hye-yoon, a researcher at KTB Investment & Securities, said, “The policy focus is on expanding domestic demand to flexibly reduce the economic gap with the U.S. and resolve accumulated imbalances during the high-growth phase. Yuan appreciation will also facilitate achieving goals by strengthening purchasing power.”

Moreover, considering the opening of financial markets, stabilizing the yuan's value is necessary. Researcher Im stated, “As China reduces export dependence and expands domestic demand, the current account surplus is likely to decrease, requiring capital for investment to be raised from overseas. To reduce the burden of securing capital, financial market opening is necessary, and yuan appreciation is favorable for capital inflows.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)