If Interest Rates Rise, RBC Ratio Falls

Insurance Companies Respond by Issuing Subordinated Bonds

[Asia Economy Reporter Oh Hyung-gil] DB Insurance plans to issue subordinated bonds on the 10th. The issuance size was initially around 300 billion KRW, but recent demand forecasts indicate that demand has more than doubled, suggesting the size may increase. Last month, Hyundai Marine & Fire Insurance and KB Insurance issued subordinated bonds worth 350 billion KRW and 379 billion KRW respectively this month. Prior to that, Meritz Fire & Marine Insurance, Mirae Asset Life Insurance, and DGB Life Insurance also completed large-scale subordinated bond issuances.

Insurance companies are raising capital to maintain their Risk-Based Capital (RBC) ratios. With market interest rates turning upward, concerns are emerging that insurers' capital adequacy could decline. Additionally, capital uncertainty is increasing due to the introduction of the new international accounting standard (IFRS17) and the new solvency ratio (K-ICS) in 2023.

According to the insurance industry on the 5th, rising interest rates are positive for insurers' fundamentals. When interest rates rise, insurers' interest margin improves. Typically, since liabilities have longer durations than assets, the increase in interest rates is expected to have a positive effect on equity capital.

However, bond valuation losses increase, reducing the available capital of insurers holding large bond portfolios. This is why a decline in RBC ratios due to rising interest rates is anticipated.

When interest rates rise, the valuation gains on the multi-trillion KRW bonds held by insurers decrease, leading to a reduction in available capital. The RBC ratio, a measure of capital adequacy, is calculated by dividing available capital by required capital; thus, if the numerator (available capital) decreases, the RBC ratio falls.

As of the end of March, insurers' total assets stood at 1,314.6 trillion KRW and equity capital at 133.7 trillion KRW, down 6.7 trillion KRW (0.5%) and 9.6 trillion KRW (6.7%) respectively compared to the end of December last year. This reflects a 11 trillion KRW (22.6%) decrease in valuation gains on available-for-sale securities due to rising interest rates.

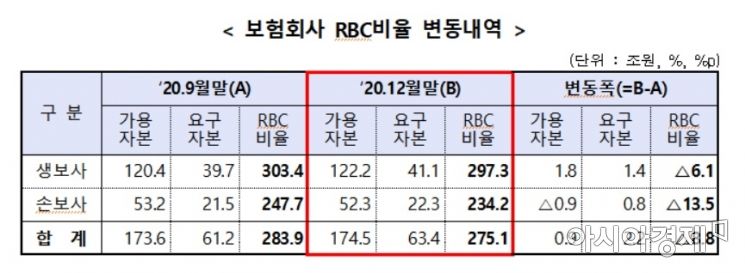

Status of RBC Ratios by Insurance Company (As of the End of 2020. Source: Financial Supervisory Service)

Status of RBC Ratios by Insurance Company (As of the End of 2020. Source: Financial Supervisory Service)

As a result, many insurers' RBC ratios have declined. According to the Financial Supervisory Service, Samsung Life Insurance's RBC ratio at the end of Q1 this year was 332%, down 21 percentage points from 353% at the end of December last year.

Hanwha Life's RBC ratio fell 33 percentage points to 205% compared to the end of last year, Kyobo Life dropped 42.2 percentage points from 333.4% to 291.2%, and NongHyup Life decreased 43.7 percentage points from 287.7% to 235%.

Samsung Fire & Marine Insurance's RBC ratio also fell below 300% to 285.2% at the end of March, while Hyundai Marine & Fire Insurance recorded 177.6%, and KB Insurance 163.8%.

The Insurance Business Act requires maintaining an RBC ratio above 100%, and financial authorities recommend keeping it above 150%. If it falls below 100%, regulatory measures such as management improvement recommendations, demands, or orders can be imposed on insurers.

In particular, the implementation of IFRS17 could further destabilize financial soundness. The duration of insurers' liabilities is expected to extend from the current 30 years to 50 years, and as liability duration increases, most insurers' RBC ratios are projected to decline.

Financial authorities are also paying close attention to this downward trend in RBC ratios. A financial regulator stated, "If RBC ratio vulnerabilities are a concern, we plan to strengthen crisis scenario analysis and proactively enhance financial soundness through capital increases and other measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)