Financial Services Commission Holds Private Meeting with Cryptocurrency Exchanges

Consulting on Reporting under Special Financial Transactions Act

Banking Sector Still Reluctant to Partner with Real-Name Accounts, Raising Risk of Mass Closures

[Asia Economy Reporter Kim Jin-ho] Financial authorities are expected to begin a full-scale 'sorting out' of cryptocurrency exchanges. On the 28th, as part of the government's 'Cryptocurrency Transaction Management Plan,' the consulting process for reporting and registration under the Act on Reporting and Using Specified Financial Transaction Information (Special Financial Transactions Act), which imposes anti-money laundering obligations, was limited to 20 major cryptocurrency exchanges. Analysts interpret this as applying the 'survival of the fittest' principle, aiming to save these exchanges that account for over 90% of the entire market to minimize consumer damage.

However, some predict that since banks still hesitate to partner with these exchanges, the possibility of a 'mass closure' among them cannot be ruled out. This is because only four large exchanges?Upbit, Bithumb, Korbit, and Coinone?currently meet all the reporting requirements under the Special Financial Transactions Act.

According to the financial sector on the 4th, the Financial Intelligence Unit (FIU) under the Financial Services Commission held a meeting yesterday at the Bankers' Hall in Myeong-dong, Seoul, with 20 major cryptocurrency exchanges including Upbit, Bithumb, Coinone, and Korbit.

The meeting was the first event hosted by the Financial Services Commission, the main government body responsible for managing and supervising cryptocurrency operators. Held privately, the meeting was arranged to specifically explain the government's stance on managing cryptocurrency operators and to guide future institutional improvements.

Notably, only 20 cryptocurrency exchanges attended the meeting. Considering that the number of cryptocurrency exchanges is known to range from as few as 60 to as many as 200, only a small number of exchanges were invited by the financial authorities.

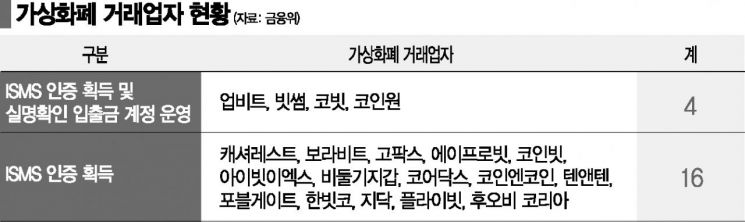

The commonality among these exchanges is that they have obtained Information Security Management System (ISMS) certification. According to the Special Financial Transactions Act, cryptocurrency operators must secure ISMS certification and deposit/withdrawal accounts with real-name verification from banks by September 24 to register.

The fact that only exchanges meeting certain criteria were invited to the meeting has led the financial sector to speculate that the Financial Services Commission has taken its first step in cryptocurrency management and supervision by 'sorting out the wheat from the chaff.' This reflects the reality that there are too many small-scale operators lacking sufficient anti-money laundering capabilities and that even those with some scale find it difficult to meet the stringent reporting requirements.

In fact, with the Special Financial Transactions Act's grace period just over three months away, no exchanges have completed registration. A financial sector official said, "Considering that the 20 exchanges invited to the meeting all have ISMS certification, it seems the financial authorities regard them as priority management targets," adding, "These exchanges account for over 90% of the total market."

Concerns Over 'Mass Closure of Exchanges' at End of September When Special Financial Transactions Act Deadline Ends

There is also analysis that financial authorities are effectively applying the 'survival of the fittest' principle to the cryptocurrency industry, encouraging the cleanup of poor-performing small and medium-sized exchanges. By saving only these dominant exchanges, consumer damage caused by the 'mass closure of exchanges' raised in the market can be minimized.

However, despite efforts such as consulting by financial authorities, concerns remain that a significant number of cryptocurrency exchanges will close en masse by the end of September when the Special Financial Transactions Act's grace period expires. For small and medium-sized exchanges in poor condition, it is practically difficult to pass the 85 evaluation items of the ISMS. Even exchanges that have obtained ISMS certification still face challenges in partnering with banks to issue real-name accounts.

Only the four major exchanges?Upbit, Bithumb, Coinone, and Korbit?have met both reporting requirements under the Special Financial Transactions Act: ISMS certification and partnership with banks for real-name account issuance. Another financial sector official stated, "Banks (KB Kookmin, Hana, Woori) that currently do not have partnerships with exchanges have internally agreed not to plan any future partnerships," adding, "Although there is an effect in attracting customers, the perception is that the risks of financial accidents such as money laundering and hacking are high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.