A Model Hard to Find Even in Stores, Available on Luxury Platforms

“Dear customer, there are 200 teams ahead in the waiting line. The estimated waiting time is unknown.”

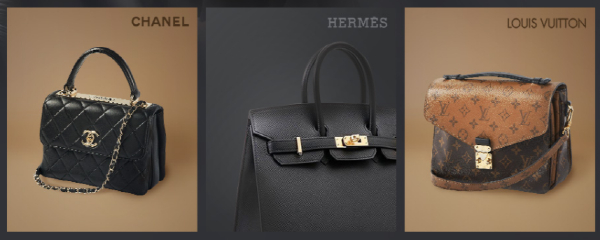

As the number of people waiting continues to increase behind the lines in front of the three luxury giants Herm?s, Louis Vuitton, and Chanel stores, purchasing products from popular high-end luxury brands feels like a battle.

Despite Louis Vuitton raising prices four times in a single year, and Chanel bags that once cost 7 million KRW now exceeding 10 million KRW, the end of the waiting line is nowhere in sight. Waiting times easily exceed four hours just to enter the store, and with a waiting ticket numbered in the 200s drawn at 10 a.m., entry is only possible well into the afternoon.

Even this year, amid the continued spread of COVID-19 and an unstable consumer market, the soaring value and scarcity of Erusha could not be stopped. Led by the popularity of Erusha, the overall luxury market performance improved, boosting department store sales as well. Last year, Louis Vuitton Korea’s sales reached 1.0468 trillion KRW, a 33.4% increase compared to 2019.

The fundamental cause of luxury price increases and scarcity is limited supply and explosive demand. As luxury prices rise, brands reduce the quantity released, selling small amounts of luxury goods at high prices to encourage consumers to purchase exclusivity reserved for a few.

In the case of Herm?s, the supply of Birkin and Kelly bags is limited to 120,000 units annually. Because the supply itself is small, luxury-free luxury halls have become a reality. Following explosive revenge consumption, luxury bags and clothing have become part of everyday consumer culture. Additionally, the fear of missing out?known as the “FOMO syndrome (Fear Of Missing Out)”?which is the anxiety of not wanting to miss an opportunity or fall behind trends, is spreading, further fueling the luxury craze.

The main consumers of luxury goods are undoubtedly the MZ generation. As the MZ generation has become the core of the luxury consumption market, the marketing industry is mobilizing all marketing tools targeting them. The recently opened Gucci store “Gucci Gaok” attracted attention with content emphasizing Korea’s unique hip culture. The MZ generation no longer views luxury as mere consumption but as an investment, even leading the luxury resale market. They quickly acquire limited edition products and resell them at a premium, and Erusha, which commands a large premium, is a highly lucrative item.

As the scarcity of Erusha continues, consumers are turning their attention to online luxury platforms. Among them, Philway, the longest-established domestic online luxury platform, is actively meeting consumer demand by securing Erusha inventory.

Philway was the first in Korea to operate a luxury platform service, building an extensive luxury transaction record and forming a luxury collection. With 5,500 Chanel bags, 2,000 Herm?s bags, and 8,000 Louis Vuitton bags secured, Philway offers relatively easy access to Erusha bags that are hard to find in department store luxury halls.

Information that hard-to-find Erusha products are available on Philway has spread through luxury communities, elevating Philway as a sanctuary for Erusha limited editions and drawing attention.

A Philway representative stated, “Philway has not hurriedly secured products in a short period but has expanded its product spectrum year by year for nearly 20 years. Recently, as Erusha products have become scarce, it is only natural that consumers flock to Philway, which has a rich selection of products that cannot be found in department stores.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.