[Asia Economy Reporter Jeong Hyunjin] "Please allocate additional budget in the second half of the year to expand logistics support for small and medium export companies."

On the 3rd, Koo Ja-yeol, Chairman of the Korea International Trade Association, raised the issue of the "worsening logistics crisis" as a major topic during a meeting with Prime Minister Kim Boo-kyum and heads of economic organizations. This was because measures were needed for small and medium export companies experiencing burdens from rising shipping freight rates and difficulties in securing vessels amid the global logistics chaos. Chairman Koo also requested the reinstatement of the tax credit for third-party logistics costs under the Restriction of Special Taxation Act, which expired at the end of last year.

"Small and medium enterprises are extremely worried"

Small and medium export companies mainly use maritime transport, which is at the core of the recent logistics crisis. While high value-added products such as semiconductors, wireless communication devices, and pharmaceuticals, as well as large corporations' items, have an air transport share of 80-90%, textiles, home appliances, and petroleum products rely heavily on maritime transport. The rise in maritime freight inevitably leads to increased costs for small and medium enterprises. Especially when export volumes are low, there is little room to negotiate freight rates, forcing them to bear high costs as is. Chairman Koo explained, "Small and medium enterprises inevitably face enormous worries."

Moreover, since January last year, the implementation of the Cargo Safety Freight System has increased logistics-related burdens for small and medium enterprises. This system guarantees appropriate freight rates to cargo truck owners and imposes legal sanctions if violated. Consequently, small and medium export companies have also faced increased land transportation costs.

The tax credit for third-party logistics costs under the Restriction of Special Taxation Act, which Chairman Koo proposed to reinstate, has been in place for over ten years. It is a system that provides a tax credit of 3% for medium-sized companies and 5% for small and medium companies on logistics costs exceeding the previous year's amount, aimed at increasing the use of third-party logistics companies. While logistics costs were low in the past, in the current situation of rapidly rising freight rates, this system inevitably offers greater benefits to small and medium enterprises.

According to the National Assembly Budget Office, in 2012 when the Shanghai Containerized Freight Index (SCFI), a global shipping freight indicator, exceeded 1400, the amount of tax credits granted under this system was 28.6 billion KRW, significantly higher than in other years. Considering this, Chairman Koo requested the system be reinstated as one of the options to help reduce logistics cost burdens for small and medium enterprises.

"Current situation may continue until next year"

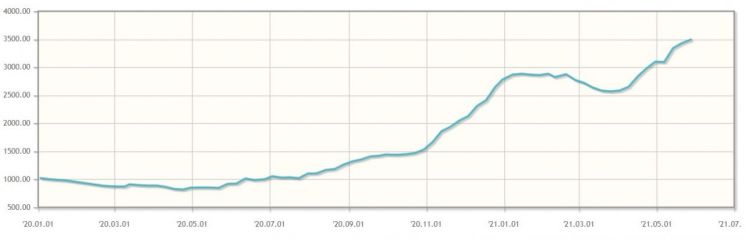

Global shipping freight index Shanghai Containerized Freight Index (SCFI) (Source: Korea Customs and Logistics Association, SCFI)

Global shipping freight index Shanghai Containerized Freight Index (SCFI) (Source: Korea Customs and Logistics Association, SCFI)

Chairman Koo emphasized the need for budget support because the logistics crisis is severe and shows no signs of resolution in the short term. As of the 28th of last month, the SCFI recorded 3495.76 per TEU (1 TEU equals one 20-foot container), nearly four times higher than the same period last year. This is due to the rapid increase in cargo volume, especially in North America, as cargo volumes frozen by COVID-19 have quickly resumed. Chairman Koo stressed, "In the past year alone, freight rates on European routes have increased sixfold, Southeast Asian routes fivefold, and American routes doubled."

The punctuality of global shipping companies, which indicates how well scheduled sailing times are maintained, has also significantly declined. According to Danish shipping analytics firm Sea-Intelligence, the punctuality rate for all routes in April was 39.2%, remaining below 40% since early this year. This means only 4 out of 10 vessels arrived at the promised time. Before COVID-19, punctuality was around 70-80%, but it sharply dropped in the second half of last year and has remained below 40% since early this year. Container ships have been continuously observed waiting offshore at ports such as Los Angeles-Long Beach in the U.S. and Qingdao in China without being able to dock.

An industry insider said, "The current situation is expected to continue through the second half of this year and, conservatively, until next year. There is also speculation that logistics costs may not return to pre-COVID-19 levels in the mid to long term," adding, "Measures to respond to this are essential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.