Various Specialized Small and Medium Enterprises IPOs Lined Up

Big Deals Coming in Second Half... Record-High Total Public Offering Amount

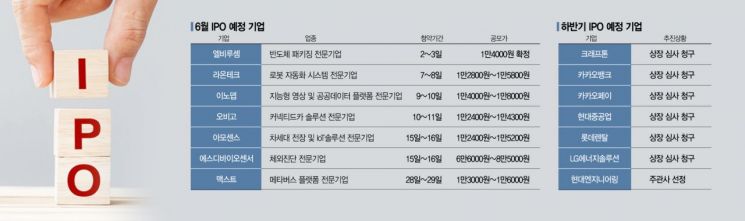

[Asia Economy Reporter Lee Seon-ae] The initial public offering (IPO) market is expected to heat up again in June. The enthusiasm for public subscription of new stocks that began last year has continued into this year. Although major IPOs such as SK Bioscience and SK IE Technology were completed in the first half of the year, various small and medium-sized companies' public subscriptions are lined up this month.

According to the Korea Exchange on the 3rd, semiconductor packaging specialist LB Rusem is conducting a general subscription from the 2nd through today. The final public offering price was set at 14,000 KRW following a demand forecast conducted for institutional investors on May 26-27. A total of 1,596 institutions participated, resulting in a competition rate of 1,419 to 1. The scheduled listing date is the 11th. In the first quarter of this year, sales and operating profit reached 10.5 billion KRW and 1.7 billion KRW respectively, marking the highest performance since its establishment in March 2000.

Raontech, which will hold its general subscription on the 7th and 8th, is a company specializing in robot automation systems. It has been listed on KONEX since December 2015 and is preparing to transfer to KOSDAQ. The desired price per share is between 12,800 KRW and 15,800 KRW. Raontech is the only company in Korea to have succeeded in mass-producing vacuum robots for wafer transfer. In July last year, it received an A grade from the Electronics and Telecommunications Research Institute for its technology on ‘manufacturing vacuum robots and transfer modules for wafer transfer in a vacuum environment,’ meeting the requirements for a technology-special listing.

Innodep, which will conduct its general subscription on the 9th and 10th, operates a data processing solution business necessary for various industries based on video analysis technology. Through its proprietary artificial intelligence (AI) deep learning technology ‘IDL,’ it provides real-time, multi-channel intelligent video analysis solutions and urban data platform services. It also possesses intelligent video analysis technology using closed-circuit television (CCTV). The desired price per share is between 14,000 KRW and 18,000 KRW.

Additionally, companies such as Amosense, a next-generation electric vehicle and Internet of Things (IoT) specialist; SD Biosensor, a company specializing in in-vitro diagnostics; and Maxst, a metaverse platform specialist, are conducting general subscriptions. Maxst holds core technology related to augmented reality (AR). Over 10,000 developers in about 50 countries worldwide have used Maxst’s AR development platform to launch more than 6,900 AR applications. It is not just the number of clients that is impressive; Maxst also conducts business with major Korean conglomerates such as Samsung Electronics, Hyundai Motor Company, and Daewoo Shipbuilding & Marine Engineering.

In the second half of the year, IPOs of companies expected to surpass the major ones from the first half are awaiting. Krafton, KakaoBank, KakaoPay, Hyundai Heavy Industries, and Lotte Rental have filed for listing review with the Korea Exchange. LG Energy Solution is expected to file for listing review within this month. LG Energy Solution’s valuation is projected to reach up to 100 trillion KRW. The public offering size is expected to be around 10 trillion KRW, making it the largest ever. Hyundai Engineering recently completed the selection of its lead underwriters.

If these IPOs proceed without issues, the total IPO public offering amount this year is expected to set a record high. The record for the largest annual IPO public offering amount was 10.908 trillion KRW set in 2010, but this year is expected to exceed 20 trillion KRW. Already, the amount has surpassed 6 trillion KRW in the first half alone, estimated to reach about 6.5 trillion KRW. This far exceeds last year’s record of 4.5226 trillion KRW in just the first half of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)