AMC Rises 100% in One Day After Free Popcorn Giveaway Announcement

Experts Say "It Signifies the Arrival of a New Type of Investment"

[Asia Economy Reporter Kim Suhwan] "The meme stock craze has returned. Stronger than ever."

Bloomberg reported this in response to the nearly 100% surge in the stock price of AMC, a U.S. movie theater chain and one of the 'meme stocks' that soared during the GameStop incident. Other meme stocks are also showing upward trends, signaling a possible replay of the GameStop saga. Some analysts argue that this should no longer be seen as a temporary craze but as a new form of investment that cannot be explained by existing theories.

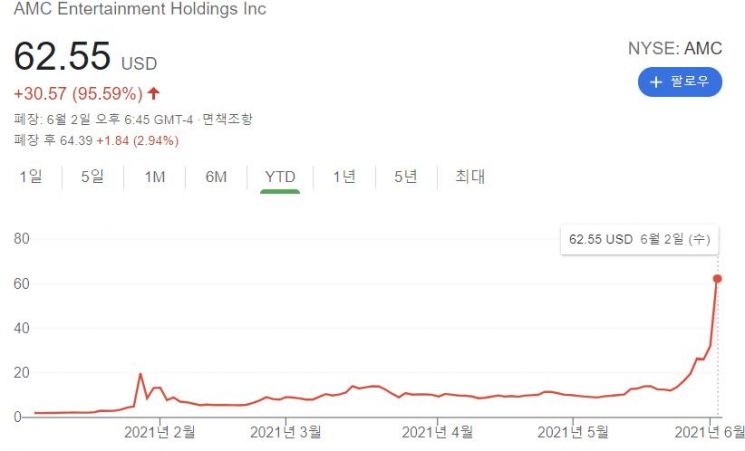

On the 2nd (local time), AMC closed at $62.55, up 95.22% from the previous trading day on the New York Stock Exchange.

This is more than three times the peak of $19.90 during the GameStop incident in January. It has also surged 2850% just this year.

In addition, other meme stocks such as GameStop, which rose 13% that day, Bed Bath & Beyond up 62%, and BlackBerry up 32%, are also riding the upward trend again.

The sharp rise in AMC's stock price that day was due to AMC's announcement that it would offer various giveaways such as free popcorn and special screenings to encourage individual investors to invest.

It is known that individual shareholders currently account for 80% of AMC's shareholders, and it is claimed that their actions drove the stock price up.

Previously, during the GameStop incident in January, the surge in meme stocks like AMC was driven by numerous individual investors, including the U.S. Reddit community WallStreetBets.

They targeted stocks with high short-selling ratios. Contrary to the expectations of short sellers betting on price declines, the influx of individual investors caused stock prices to rise, prompting short sellers to buy back shares to minimize losses, which in turn drove the stock price surge.

AMC's short-selling ratio accounts for 20% of total trading volume, significantly exceeding the average 5% short-selling ratio of U.S. companies.

After AMC succeeded in the largest-ever rights offering in the first quarter, individual investors expecting improved profitability began to flock in, and short sellers also bought shares to reduce losses, causing the stock price to rise 116% just last week. CNBC reported that short sellers suffered losses exceeding $1.2 billion.

Previously, many experts dismissed this meme stock craze as a temporary phenomenon, attributing price fluctuations to some irrational investors.

However, as signs of a replay of the GameStop incident appear after half a year, some argue that a new type of investor has emerged.

AMC, a US movie theater chain, has seen its stock price rise by 2850% just this year [Image capture=Google Stocks]

AMC, a US movie theater chain, has seen its stock price rise by 2850% just this year [Image capture=Google Stocks]

Jim Cramer, a famous analyst from CNBC, called it a "phenomenon that cannot be explained by existing theories" and emphasized that it is time to view meme stocks from a new perspective.

Although he also analyzed that AMC's current stock price is overvalued, he said, "This kind of valuation no longer works on Reddit investors." He diagnosed that "For young investors represented by Reddit, stock valuation or corporate financial evaluation is not important; they simply buy stocks because they 'like' them." This suggests a large influx of new investors departing from the traditional investment approach of carefully analyzing corporate financials and growth potential before trading stocks.

He added, "These investors have become a new power in the market," and "It is very reckless for short sellers to challenge them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.