"Quality Will Decline" Employees Oppose

Pulmuone Secures 3 out of 5 Samsung Meal Service Bids

[Asia Economy Reporter Lim Hye-seon] Although the government has stepped forward to open large corporations' cafeterias to support small and medium-sized food companies, a situation has arisen where mid-sized companies are monopolizing the catering market. The small and medium-sized enterprises (SMEs) that the government intended to benefit are burdened by operating large cafeterias with over 1,000 meals per day, leading them to either give up bidding altogether or lose in competition.

Zero Mid-Sized Companies in Samsung's Opened Cafeterias

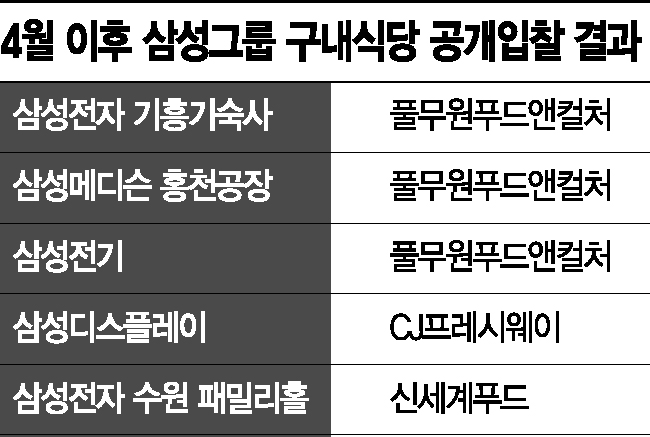

On the 2nd, among the five external catering service competitive bids conducted by Samsung Group, mid-sized company Pulmuone Food & Culture secured the operating rights for three locations. The remaining two were taken by CJ Freshway and Shinsegae Food, subsidiaries of large corporations. Since the Fair Trade Commission announced in early April that it would open up cafeteria contracts worth 1.2 trillion won from large corporate groups, Samsung Group was the first to open the market, but in reality, no small or medium-sized company obtained any operating rights.

Over the past two months, Samsung Group held public bids for five cafeterias: Samsung Electro-Mechanics, Samsung Medison Hongcheon Plant, Samsung Electronics Giheung Dormitory, Samsung Display, and Samsung Electronics Suwon Family Hall. Pulmuone Food & Culture won the contracts for Samsung Electro-Mechanics, Samsung Medison Hongcheon Plant, and Samsung Electronics Giheung Dormitory; CJ Freshway took Samsung Display; and Shinsegae Food secured Samsung Electronics Suwon Family Hall.

"Market Entry Itself Is Difficult for SMEs"

The catering industry responded by saying, "Concerns have become reality." An industry insider explained, "It is honestly difficult for SMEs, which lack food material distribution networks, to handle large-scale operations of over 1,000 meals per day," adding, "Even if large corporations' participation is restricted, the structure makes it hard for SMEs to enter." In fact, over 80% of large corporate workplaces serve more than 1,000 meals daily. For example, SK Hynix's Icheon Research and Development (R&D) Center semiconductor campus serves over 10,000 meals. Employees also showed reluctance to select SMEs. An industry source said, "Since it is part of in-house welfare projects, the labor union's opinion is important in cafeteria selection, and most felt it was inappropriate to entrust the business to unverified SMEs."

Ultimately, there is speculation that mid-sized companies and subsidiaries of large corporations will take turns dividing the opened large corporate group catering market. The 4.3 trillion won group catering outsourcing market is dominated 80% by five companies: Samsung Welstory, Ourhome, Hyundai Green Food, CJ Freshway, and Shinsegae Food. Although Pulmuone Food & Culture (5.1% sales share), Hanwha Hotels & Resorts (4.9%), and Dongwon Home Food (2.8%) exist, their market shares are not significant. SMEs account for a negligible 40 billion won scale, less than 1%.

SMEs Also Marginalized in Public Catering 9 Years Ago

Similar situations occurred during the 2012 public catering business bidding. The government restricted participation in public institution cafeteria bids by mid-sized companies whose large corporate group affiliates or relatives held more than 50% of shares through the 'Support Plan for Small and Medium-Sized Merchants,' but foreign company Araco and mid-sized company Pulmuone won the contracts.

The small catering companies that the government originally aimed to foster could not even participate because they failed to meet bidding criteria. The government then significantly relaxed the bidding standards to encourage active participation, but SMEs with weak food material distribution networks could not meet the low catering unit prices of public institutions and gave up bidding. The beneficiary was mid-sized company Pulmuone. Except for the second phase cafeteria at Sejong Government Complex, Pulmuone Food & Culture operates all three major government complexes in Seoul, Gwacheon, and Sejong.

An industry insider pointed out, "It is true that entrusting large bids of over 1,000 meals per day to unverified SMEs is burdensome, and since it relates to employee welfare, dissatisfaction among company employees is high, so ultimately companies classified as mid-sized are gaining the spillover benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)