Credit Loans Decrease by 3.7366 Trillion Won in One Month

[Asia Economy Reporter Park Sun-mi] Last month, household loans at the five major commercial banks turned to a decline for the first time in 4 years and 3 months. This is interpreted as the result of three factors coinciding: the increased likelihood of a base interest rate hike within the year, the upcoming enforcement of strengthened household loan management measures in July, rising loan interest rates, and the sharp drop in coin prices.

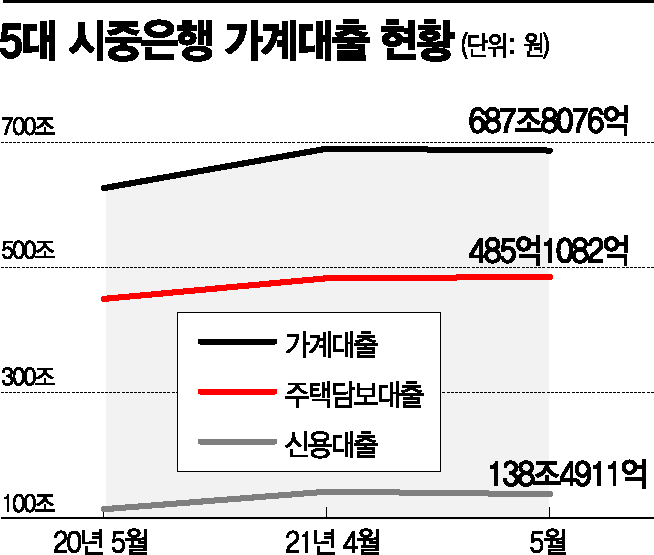

According to the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?household loan balances last month recorded 687.8076 trillion won, a decrease of 3.0546 trillion won compared to 690.8622 trillion won in April. This is the first time since February 2017 that household loan balances have decreased month-on-month.

The significant reduction in unsecured loans had a major impact. At the end of May, mortgage loan balances increased by 1.2343 trillion won from April to 485.1082 trillion won, but during the same period, unsecured loans decreased by 3.7366 trillion won from April to 138.4911 trillion won, resulting in an overall reduction in household loan volume. This is an unusual change compared to April, when unsecured loans increased by as much as 7 trillion won, marking the largest increase ever recorded.

Why the Unusual Decrease in Loans?

The 3.7 trillion won decrease in unsecured loans in just one month is believed to be influenced by the financial authorities’ announcement of household debt management measures at the end of April, which mainly include the Debt Service Ratio (DSR) regulation. This plan, aiming to reduce the household credit growth rate to the 4% range?half the level of 2019?by next year, not only pressures borrowers’ debt burdens ahead of its July enforcement but also induces commercial banks to reduce preferential loan interest rates. Moreover, with the Bank of Korea creating an atmosphere that it may raise the base interest rate within the year, the perception that debts must be reduced through repayment is spreading.

The fact that household loan interest rates, which have already risen to their highest level in 15 months, may continue to increase is also a psychological burden for borrowers. According to the Bank of Korea’s “Weighted Average Interest Rate of Financial Institutions” statistics, the overall household loan interest rate in the banking sector (weighted average, based on new loans) was 2.91% in April, up 0.03 percentage points from 2.88% in March. Since bond yields, which serve as indicators for bank loan interest rates, continue to rise in both short and long terms, the possibility of further increases in household loan interest rates remains open.

The cooling of investment enthusiasm due to the sharp decline in public offering stocks and coin prices has also put a brake on the “Yeongkkeul (borrowing to the limit)” and “Debt Investment” mentality. In fact, demand deposit balances, which strongly represent short-term standby funds for investment, recorded 654.6185 trillion won last month, down 6.4055 trillion won from April. On the other hand, bank time deposit balances, which had been draining like an ebb tide, recorded 624.3555 trillion won, an increase of 9.5564 trillion won from April.

A bank official explained, “Although household loans have unusually turned to a decline, starting in July, loan regulations will be enforced alongside measures to ease loan restrictions to support home purchases for low-income and genuine demand borrowers. Additionally, voices calling for financial support for financially vulnerable groups, including youth, are growing mainly in the political sphere, so it remains to be seen whether this trend will continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.